A rare interview with the 2013 and 2008 Morningstar International Stock Fund Manager of the Year! Portfolio Manager Daniel O’Keefe explains how his Artisan International Value and Artisan Global Value funds trounce the competition and the market in both bull and bear markets.

Global Investing

DAVID WINTERS: FIRST CLASS MERCHANDISE AT BARGAIN PRICES!

Emerging markets have substantially underperformed the U.S. stock market over the last two years. There is one area however where emerging markets, particularly those in Asia, South America and China continue to shine: demand for luxury goods. Bain & Company reports that the so called “HENRYs” (High Earnings, Not Rich Yet) consumers in those markets are becoming a “new baby boom sized generation” for luxury goods. That is the sweet spot for this week’s Great Investor guest, David Winters. Winters is the Portfolio Manager of the value-oriented Wintergreen Fund which he founded in 2005. Since inception this go anywhere, invest in anything fund has outperformed the market and its mutual fund category.

WATCH NOW…

STEPHEN SMITH: HOW WORRIED ARE YOU ABOUT THE BONDS IN YOUR PORTFOLIO?

Our Great Investor guest is a maverick bond investor and a WEALTHTRACK exclusive. He is Stephen Smith, long time co-portfolio manager of the five-star rated, Brandywine Global Opportunities Bond Fund which has delivered exceptional returns over the years. For our WEB EXTRA feature Smith discusses what he is doing with his personal portfolio. True to form, he takes a very different path from what you might expect.

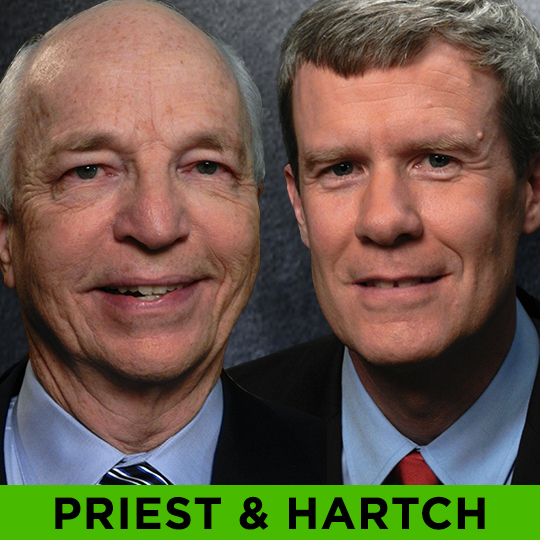

HARTCH & PRIEST: AWARD WINNING MANAGERS, CONTRASTING STRATEGIES

Epoch Investment Partners’ Bill Priest searches for yield in a wide universe; Brown Brothers Harriman’s Tim Hartch keeps a narrow focus. Find out where these two global investors with world class track records are seeing opportunities now.

Mark Headley: Asian Giants at a Turning Point?

China, which was struggling to fend off an economic hard landing just last year, has recovered. Japan, which has been stuck in a twenty-plus year trap of deflation and stagnant growth has a new Prime Minister who is determined to stimulate inflation and growth. Both nations have seen their stock markets rally in recent months […]