As mutual funds mark their 100th anniversary do they still work for investors? Answers from Morningstar’s mutual fund maven, Russ Kinnel.

RECENT PROGRAMS

Crypto expert Matt Hougan explains why Bitcoin has gone mainstream with the launch of Bitcoin ETFs

The launch of Bitcoin ETFs has brought the world’s largest cryptocurrency into the mainstream, says crypto expert Matt Hougan. It is also a major milestone in crypto’s acceptance.

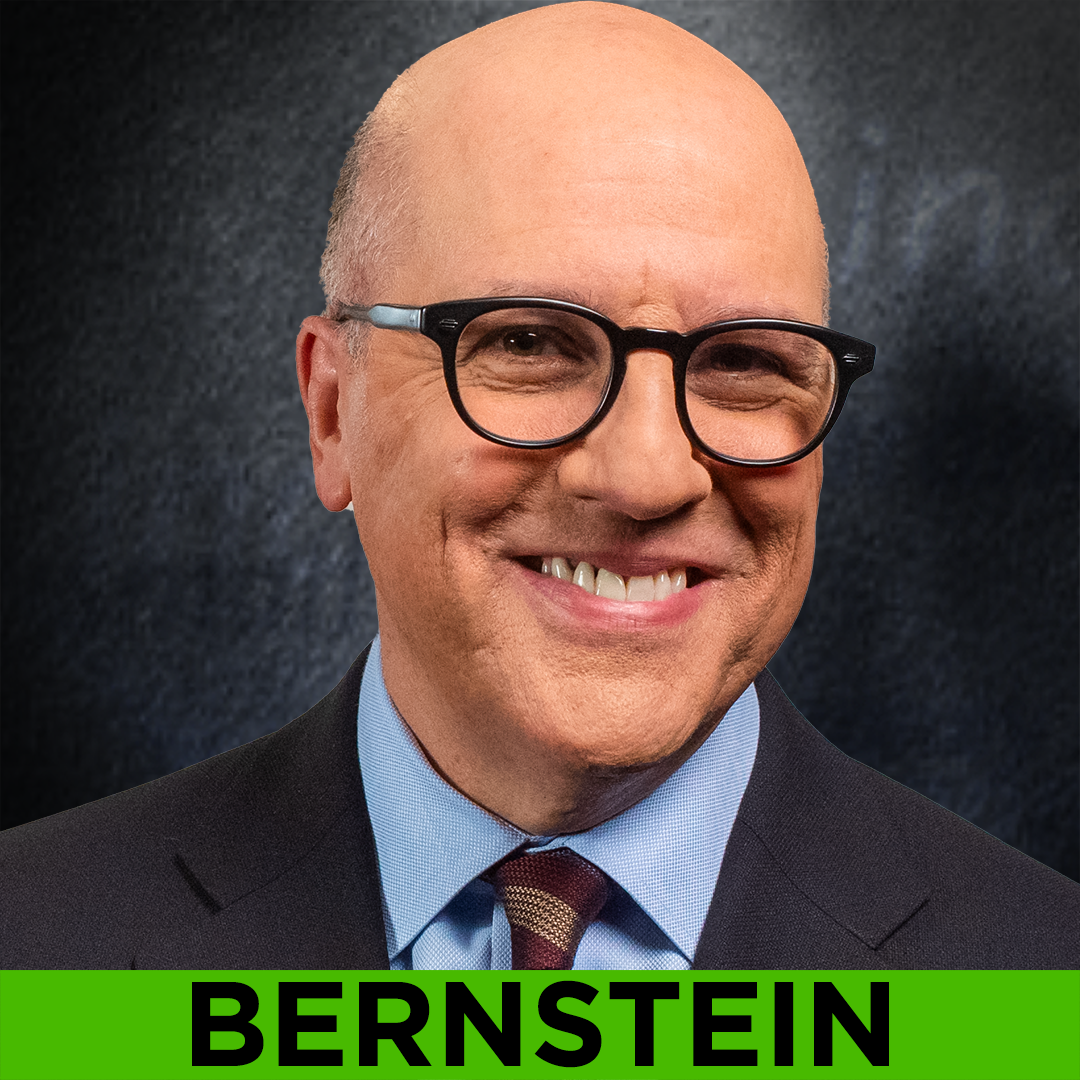

Key investment lessons of the last 20 years from noted strategist Richard Bernstein

Part 2 of 2

Noted strategist and asset allocator Rich Bernstein shares the most important investment lessons learned from the markets in the 20 years since WEALTHTRACK launch, in part 2 of his interview.

Strategist Richard Bernstein on successful investment themes of the past and his favorite one now

Part 1 of 2

Influential strategist Richard Bernstein reflects on the most successful investment themes of the last 20 years and why deglobalization and the concomitant reindustrialization of America is his number one theme now.

What Will Change, What Won’t If Warren Buffet Is No Longer At Berkshire Hathaway?

Berkshire Beyond Buffett author Larry Cunningham has become an expert on Warren Buffett’s thinking and Berkshire Hathaway’s culture and businesses over the last 30 years. He shares his analysis of what will change and what won’t when Buffett leaves the scene.

Warren Buffett’s Investment Evolution. What’s Changed, What Hasn’t Over Five Decades

In editing, collating, and compiling The Essays of Warren Buffett for 30 years, Larry Cunningham has developed an in-depth understanding of the Oracle of Omaha’s investment thinking.