Part 2 of an exclusive interview with Wall Street legends, Ed Hyman and Bill Miller! Where do both pros think there is the most money to be made this year? Hyman gives his “one free pass” for investors and Miller shares his two “no brainers.”

RECENT PROGRAMS

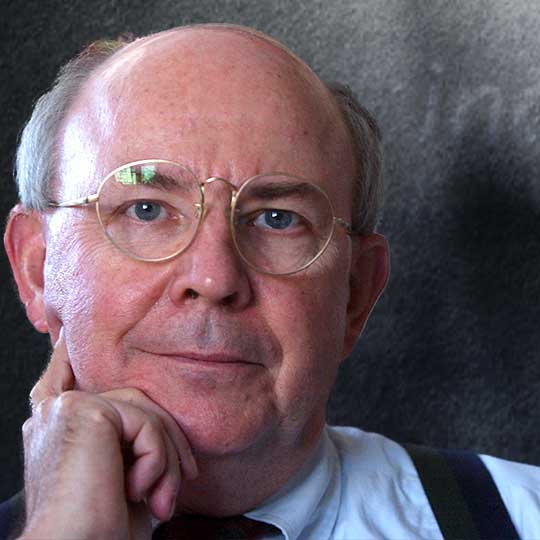

ED HYMAN & BILL MILLER – PART I – INVESTMENT LEGENDS’ PREDICTIONS FOR 2014

Two investing legends come together in an exclusive television interview this week! ISI Group’s Ed Hyman, Wall Street’s number one ranked economist for 34 years running, is joined by Legg Mason’s history-making portfolio manager Bill Miller to discuss their top investment forecasts and strategies for 2014.

RUSSO & WEITZ – DYNAMIC VALUE DUO

An exclusive get-together with two outstanding value investors! Wally Weitz, whose flagship Weitz Partners Value Fund is celebrating its thirty year anniversary, and Tom Russo, with his market-beating Semper Vic Partners Fund, will discuss the different places each is finding value and why Warren Buffet is their investment hero.

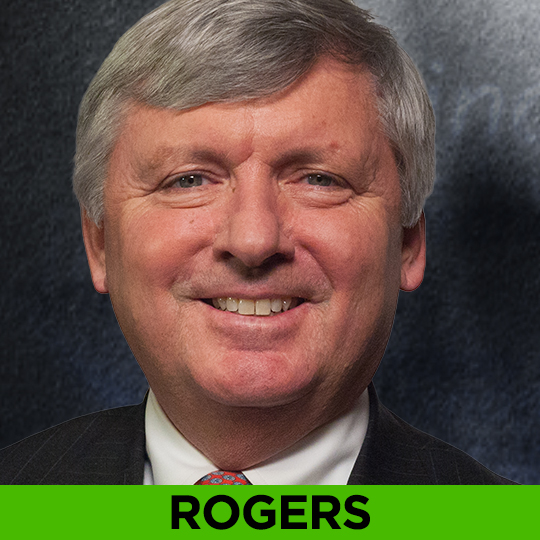

BRIAN ROGERS – NOTHING IS CHEAP

“What if nothing is cheap” in today’s market? In a rare interview, Brian Rogers, longtime portfolio of the T. Rowe Price Equity Income Fund, a Morningstar favorite, tells us why he’s worried about risks and “pockets of craziness” in the market and where he is finding value in an expensive world.

JAMES GRANT & RICHARD SYLLA: THE GREAT FED DEBATE!

Is the 100th anniversary of the creation of the Federal Reserve a cause for celebration or condemnation? Has the Fed, as Ben Bernanke said, “come full circle back to the original goal of preventing financial panics? Two financial historians, James Grant and Richard Sylla, debate the benefits and dangers of the Fed and explore its history with us.

CORTAZZO & LEBENTHAL – MINIMIZING TAX PAIN

Nothing is certain but death and taxes and what is certain this year is that taxes have gone up. Increases in the social security tax rate, Federal laws such as the Affordable Care Act and the American Taxpayer Relief Act of 2012, and stock market gains mean many Americans are facing much higher tax bills. Financial advisors Alexandra Lebenthal and Mark Cortazzo will help us minimize the pain.