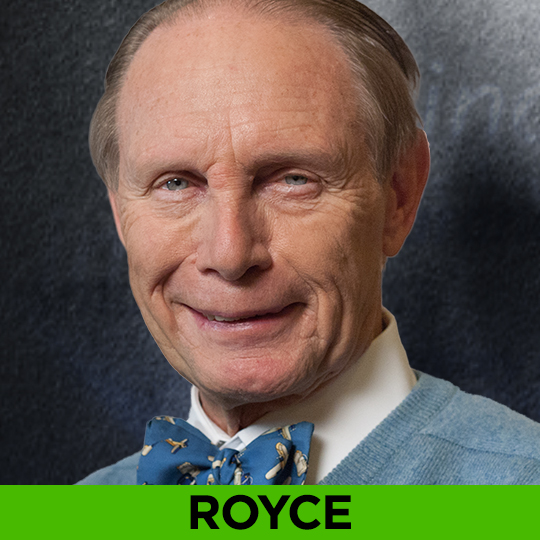

An exclusive interview with legendary “Great Investor” Charles “Chuck” Royce. Royce pioneered investing in small company stocks with his Royce Pennsylvania Mutual Fund forty years ago this year. He’ll explain why high quality small cap stocks are undervalued compared to large cap stocks right now and the advantages they offer to investors from the vantage points of portfolio diversity, international exposure and income, three characteristics normally not associated with the small cap universe.

RECENT PROGRAMS

Don Yacktman – January 27, 2012

Great Investor Don Yacktman, founder and co-manager of the Yacktman Fund tells us how he continues to beat the overall stock market landing in the top one percent of all large cap mutual funds over the past one, three, five and ten year periods. Such outstanding performance was recently recognized by Morningstar, the mutual fund rating firm, that nominated Yacktman for Domestic Manager of 2011.

CORTAZZO AND GARRETT- December 23, 2011

Two blue chip financial advisors offering wealth building advice for blue collar budgets. Sheryl Garrett of the Garrett Planning Network and Mark Cortazzo of MACRO Consulting Group discuss affordable financial services for the rest of us.

LANKFORD & BLUNT: HOW NOT TO RUN OUT OF MONEY DURING RETIREMENT

Consuelo talks to two retirement experts, columnist Kim Lankford of Kiplinger’s Personal Finance magazine and Chris Blunt, head of New York Life’s Retirement Income Security about having a stream of income no matter how long you live.

CHARLES ROYCE

An exclusive interview with legendary portfolio manager Chuck Royce. The small company stock guru explains how he has beaten the market with less risk over the last 35 years and why small is still beautiful.

CORTAZZO AND FRANKLIN PART 2 – November 12, 2010

Part two of WealthTrack’s series, “The New Retirement Reality” focuses on how to boost retirement income and guarantee a stream of income for life with Kiplinger’s retirement guru, Mary Beth Franklin and award winning Financial Planner Mark Cortazzo.