Part 1 of 2

Leading global value manager Matt McClennan on companies that thrive despite US investment risks

RECENT PROGRAMS

FORMER FED VICE CHAIR RICHARD CLARIDA SAYS THE FED WILL TIGHTEN UNTIL LONG-TERM INFLATION REACHES 2%

Former Fed Vice Chair Richard Clarida says the Fed is determined to get long-term inflation down to 2%, and some economic pain is inevitable.

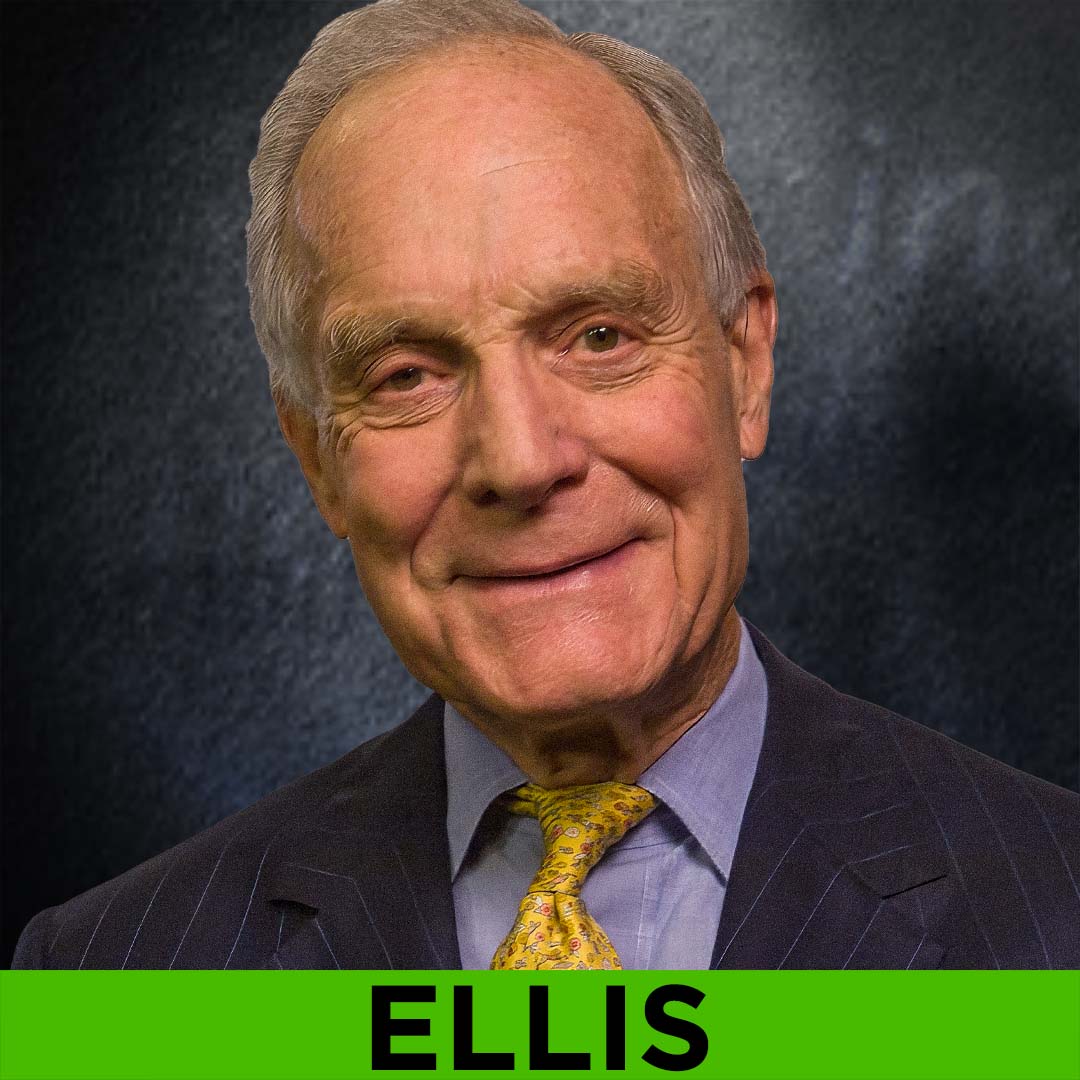

BUILDING A FINANCIAL PLAN TO MATCH YOUR UNIQUE NEEDS WITH INVESTMENT LEGEND CHARLES ELLIS

Part 2 of 2

Legendary financial thought leader Charles Ellis has spent 60 years researching and advising top investment professionals and firms. In part two of his exclusive WEALTHTRACK interview he discusses how individuals can create the best financial plan for their specific situation.

LEADING INVESTMENT STRATEGIST JASON TRENNERT IDENTIFIES FOUR MACRO THEMES SHAPING HIS PORTFOLIOS

Part 2 of 2

Ever since the global financial crisis, macro has really mattered to investment success. Leading investment strategist Jason Trennert identifies four major long-term themes shaping his portfolios

CHINA’S ECONOMIC SLOWDOWN & POLITICAL CRACKDOWNS HAVE ENORMOUS IMPLICATIONS FOR THE WORLD ECONOMY

ISI Group, co-founded by Ed Hyman, recognized early on that China would play a significant role in the global economy. As China liberalized its economy and welcomed foreign investment, it became the world’s second largest economy. However, under President Xi Jinping, some of these policies have been scaled back, leading to a change in Hyman’s view of China.

WATCH NOW…

LEADING STRATEGIST JASON TRENNERT IS UNCHARACTERISTICALLY BEARISH. HE EXPLAINS WHAT’S CHANGED

Part 1 of 2

Strategas’ Jason Trennert coined the term TINA, “there is no alternative to stocks,” over a decade ago when interest rates were perpetually low. He explains why he has replaced it with TARA, “there are real alternatives to stocks.”