First Eagle’s small-cap portfolio manager, Bill Hench, has a long track record of beating the market and the competition by discovering hidden gems among small-cap stocks with short-term problems.

RECENT PROGRAMS

CLEMENTS: TOUGHEST RETIREMENT CHALLENGE

Award-winning personal finance columnist Jonathan Clements discusses the number one topic among his HumbleDollar newsletter readers and a strategy to ease the burden.

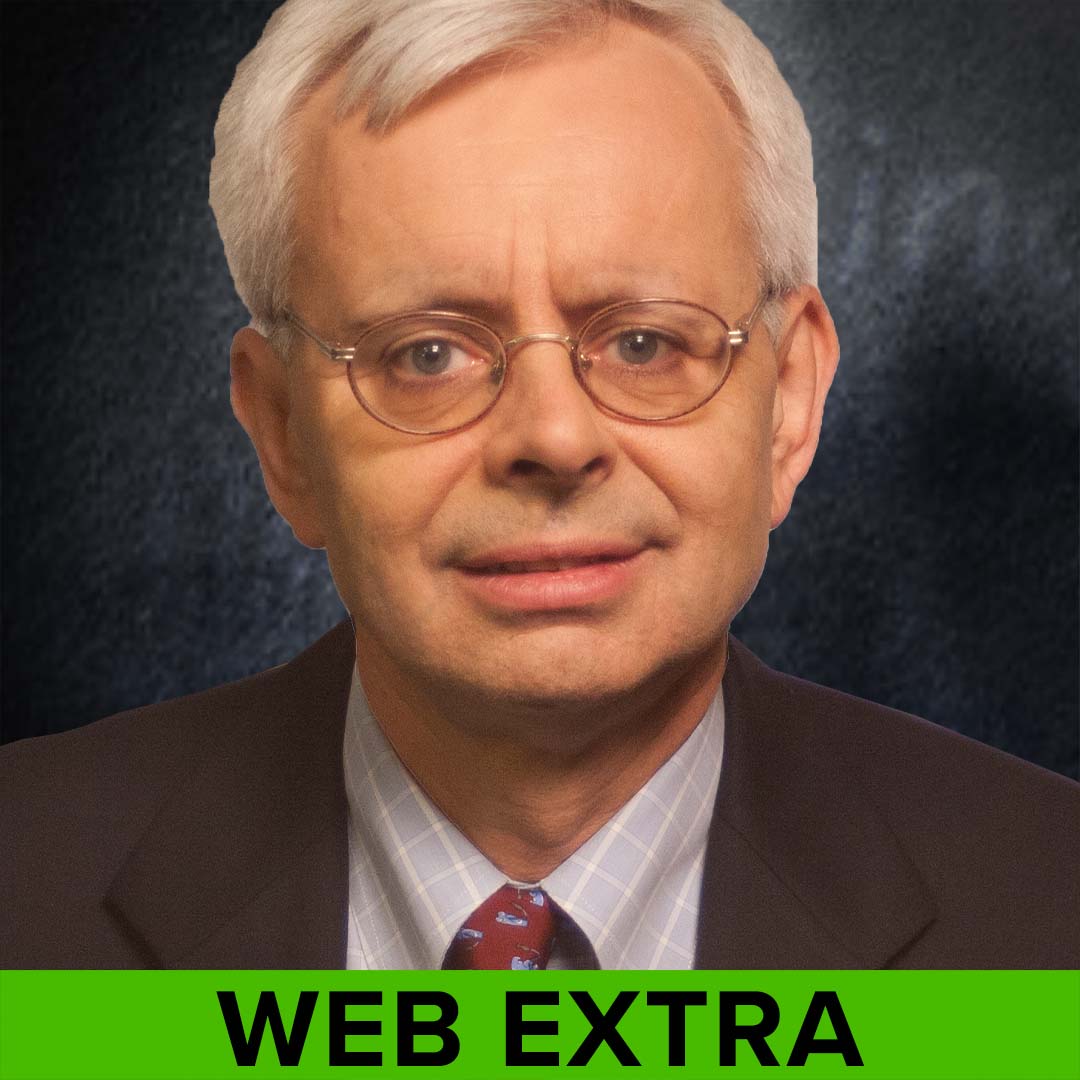

WHAT’S THE MAGIC OF TARGETING 2 PERCENT INFLATION? RICHARD CLARIDA RESPONDS TO POWERFUL CRITICS

In this EXTRA exclusive, Former Fed Vice Chair Richard Clarida defends the 2% solution.

FIFTY YEARS IN, “A RANDOM WALK DOWN WALL STREET’S” INVESTMENT ADVICE HAS STOOD THE TEST OF TIME

Fifty years and 12 updated editions later, Burton Malkiel’s investment advice in his now classic, A Random Walk Down Wall Street, has proven to be correct.

WORLD CLASS INTERNATIONAL COMPANIES SELLING AT SUBSTANTIAL DISCOUNTS TO THEIR US PEERS

Part 2 of 2

Finding world-class international companies selling at substantial discounts to their US peers with leading global value investor First Eagle’s Matthew McLennan.

LEADING GLOBAL VALUE MANAGER MATT MCLENNAN ON COMPANIES THAT THRIVE DESPITE US INVESTMENT RISKS

Part 1 of 2

Leading global value manager Matt McClennan on companies that thrive despite US investment risks