Money problems are a major source of conflict for couples and a leading cause of divorce. Victoria Collins, one of the country’s top financial advisors for many years, has strategies to handle it.

RECENT PROGRAMS

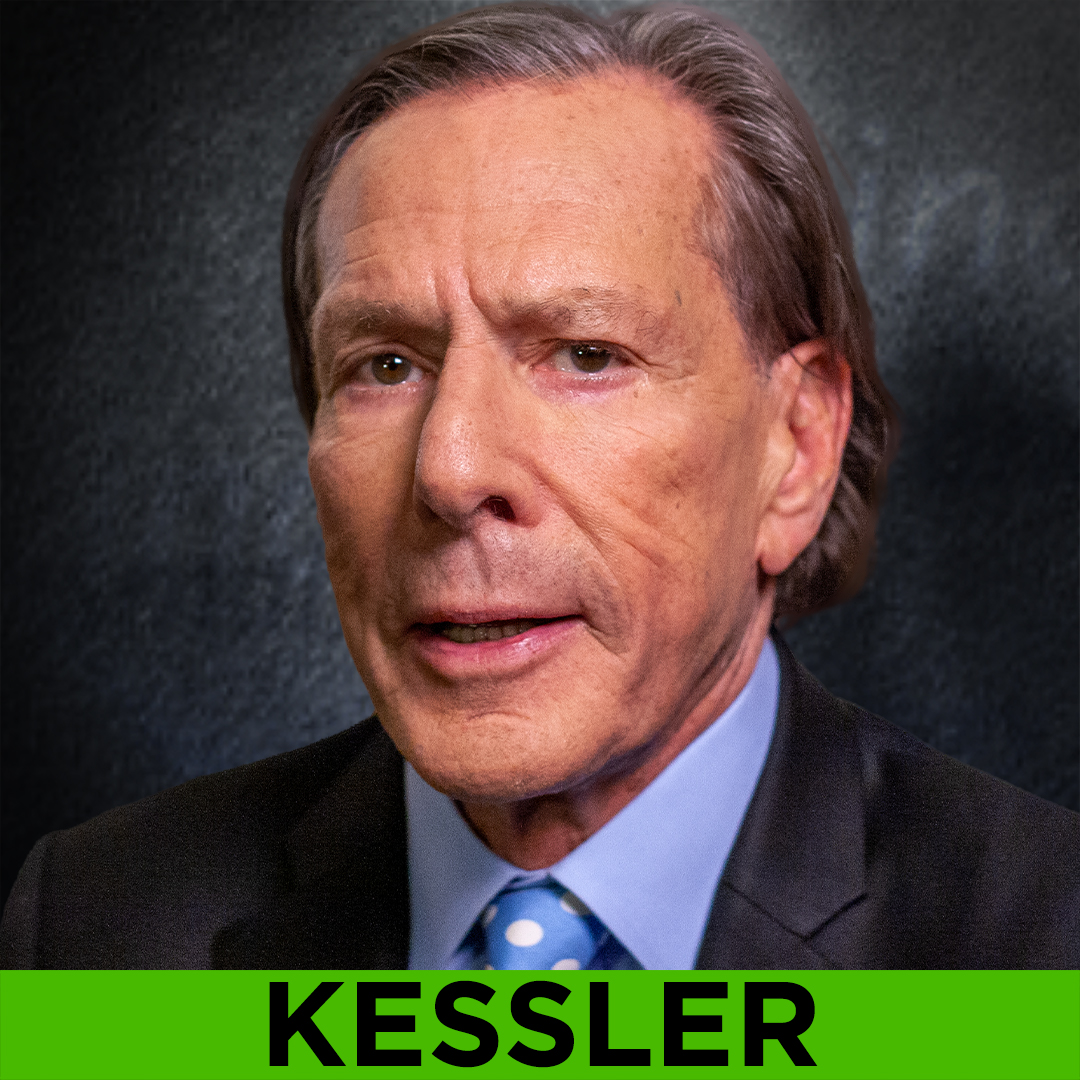

KESSLER: MORE MARKET WARNINGS

Veteran portfolio manager Robert Kessler elaborates on mounting evidence of recession & financial crisis.

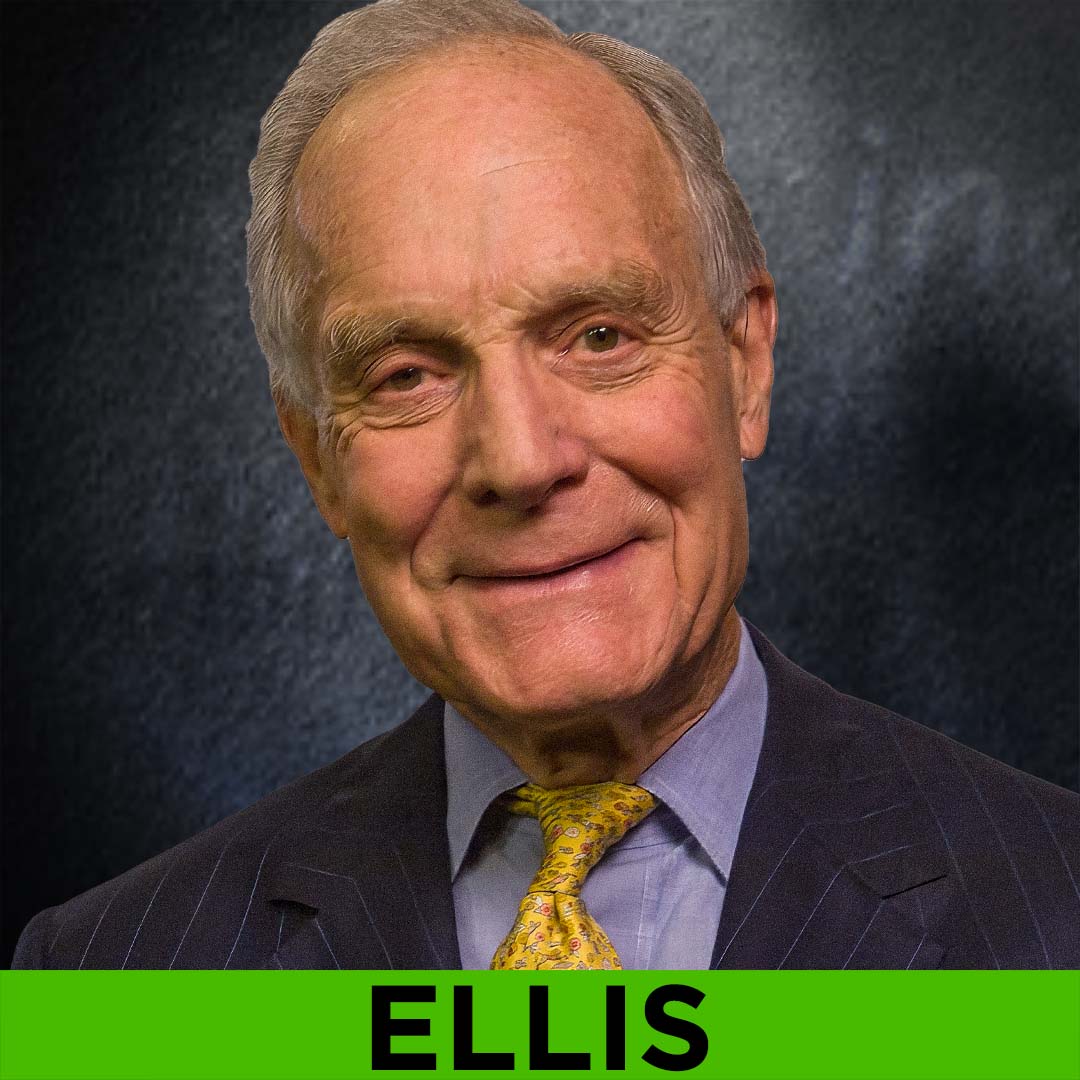

SIXTY YEARS OF INVESTMENT WISDOM FROM FINANCIAL LEGEND CHARLES ELLIS

Part 1 of 2

Sixty years of investment wisdom from financial legend Charles Ellis.

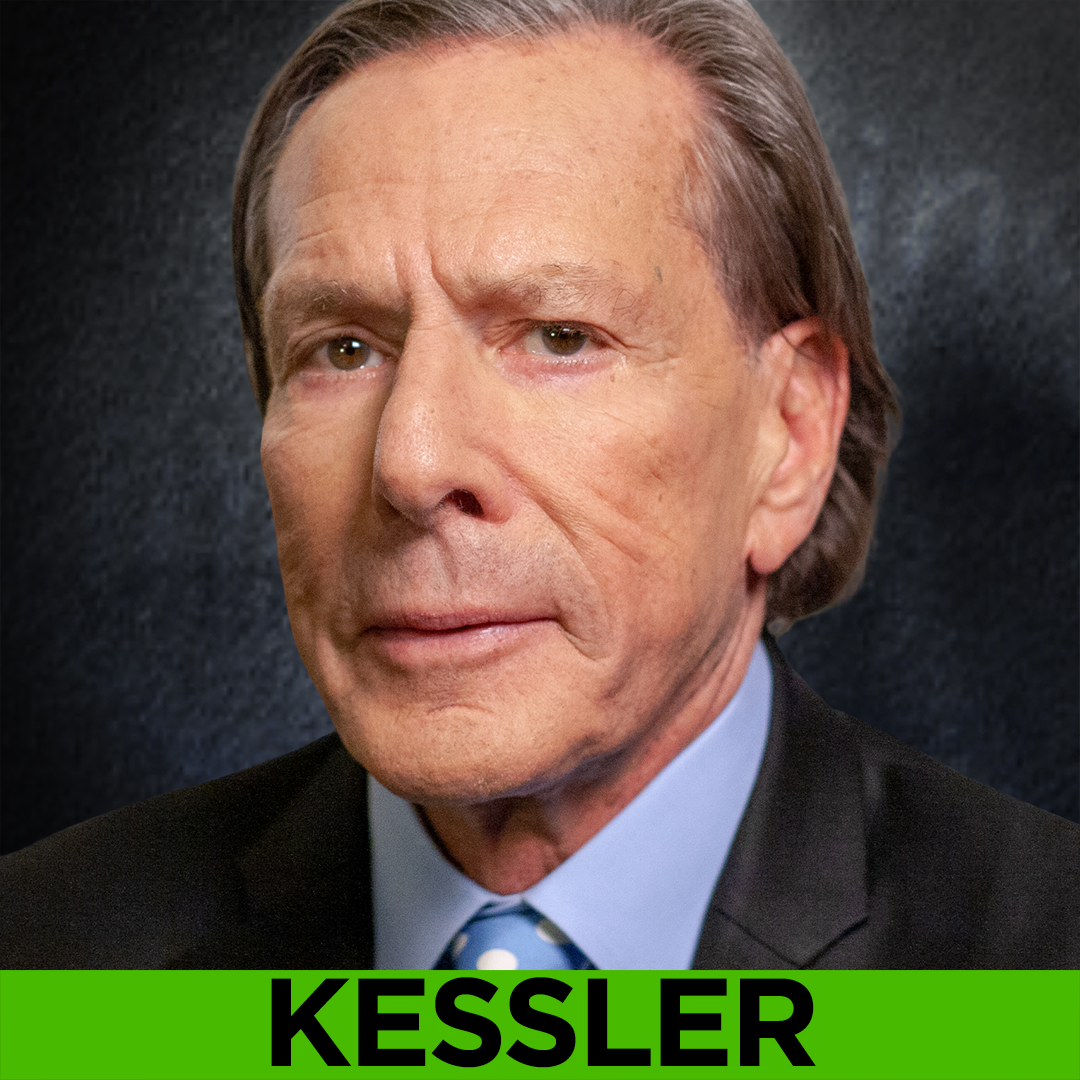

THE FINANCIAL MARKETS ARE PERILOUS, WARNS ROBERT KESSLER

Robert Kessler explains why he thinks the markets are so dangerous for investors right now. A long-time critic of Wall Street and its pervasive groupthink, the recently retired bond manager shares his contrarian advice exclusively on WEALTHTRACK.

CLARE HART’S LASER FOCUS ON QUALITY & INCOME HAS PAID OFF FOR HER JPMORGAN EQUITY INCOME FUND

A laser focus on quality and income has reaped multiple dividends for shareholders of the JPMorgan Equity Income Fund since lead portfolio manager Clare Hart took over in 2004.

PORTFOLIO & FINANCIAL PLANNING ADJUSTMENTS FOR RISING INTEREST RATES & INFLATION

Award-winning personal finance reporter and HumbleDollar editor, Jonathan Clements is lowering his expectations for future market returns and rebalancing his portfolio to reflect new financial realities