American women control $8 trillion in assets, yet the traditional wealth management approach doesn’t necessarily work for women’s needs. In the first of our two part series on Women, Investing and Retirement, Consuelo speaks with Morgan Stanley’s award-winning financial advisor, Ami Forte, and GenSpring’s Senior Strategist, Jewelle Bickford on how women can start taking ownership of their financial power.

Guests

ACTIVELY MANAGED FUNDS VS. PASSIVE INDEX FUNDS

Two seasoned investment pros argue the case for and against actively managed funds versus passive index funds.

In a surprising twist, Vanguard principal Daniel Wallick presents the active management case while award-winning financial advisor Gregg Fisher defends the passive approach.

WATCH NOW…

STEPHEN SMITH: HOW WORRIED ARE YOU ABOUT THE BONDS IN YOUR PORTFOLIO?

Our Great Investor guest is a maverick bond investor and a WEALTHTRACK exclusive. He is Stephen Smith, long time co-portfolio manager of the five-star rated, Brandywine Global Opportunities Bond Fund which has delivered exceptional returns over the years. For our WEB EXTRA feature Smith discusses what he is doing with his personal portfolio. True to form, he takes a very different path from what you might expect.

DAVID DARST: THE CYCLICAL AND SECULAR OUTLOOK FOR GOLD

In a web exclusive, Consuelo asks Morgan Stanley’s David Darst whether or not investors are too optimistic in this current run-up of the stock market. In a wide ranging interview, standard Darst fare, Consuelo also questions him about gold and why the bears are still in hibernation.

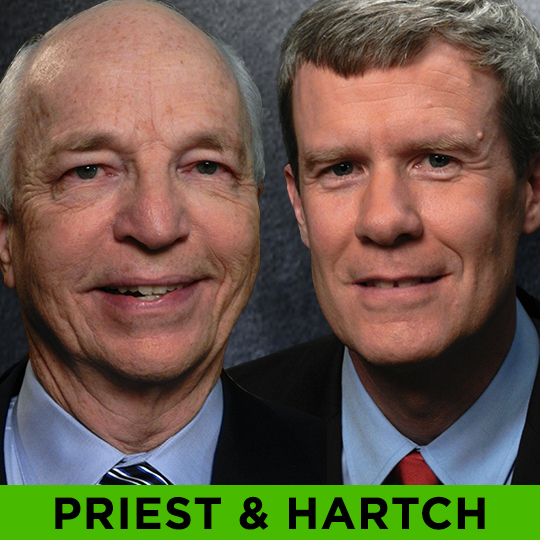

HARTCH & PRIEST: AWARD WINNING MANAGERS, CONTRASTING STRATEGIES

Epoch Investment Partners’ Bill Priest searches for yield in a wide universe; Brown Brothers Harriman’s Tim Hartch keeps a narrow focus. Find out where these two global investors with world class track records are seeing opportunities now.

ROBERT KLEINSCHMIDT: WALL STREET “TROUBLE MAKER”

Robert Kleinschmidt, long-time Portfolio Manager of the Tocqueville Fund and a well-known contrarian on Wall Street. He was bullish on stocks when every one was calling for the death of equities. He pooh poohed the effect the election and the fiscal cliff would have on the market. Now he has a very contrarian view of the Fed’s unprecedented policy to keep interest rates low.