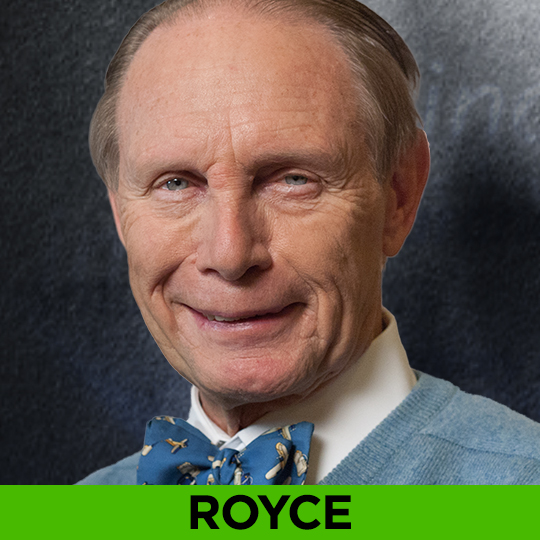

An exclusive interview with legendary “Great Investor” Charles “Chuck” Royce. Royce pioneered investing in small company stocks with his Royce Pennsylvania Mutual Fund forty years ago this year. He’ll explain why high quality small cap stocks are undervalued compared to large cap stocks right now and the advantages they offer to investors from the vantage points of portfolio diversity, international exposure and income, three characteristics normally not associated with the small cap universe.

Season 08

ED HYMAN AND BOB DOLL

An exclusive interview with Wall Street’s long time number one economist Ed Hyman and Great Investor Bob Doll. What they expect in the economy and markets in 2012 and strategies to prosper in it.

WATCH NOW…

DAVID ROSENBERG

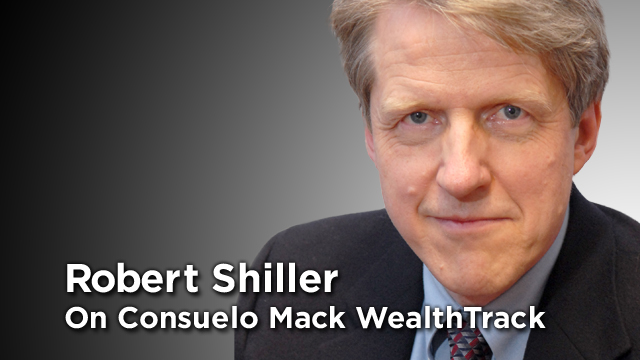

ROBERT SHILLER

Financial Thought Leader and Yale economist Robert Shiller. He predicted the bursting of the tech and housing bubbles. What does this visionary behavioral economist, author and market innovator see in our future now? Consuelo will find out.