A rare interview with T. Rowe Price’s David Giroux. The two-time winner of Morningstar’s Allocation Fund Manager of the Year award explains how he manages market risk.

WATCH NOW…

RECENT PROGRAMS

AVOIDING THE NIGHTMARE OF RUNNING OUT OF MONEY IN RETIREMENT WITH TOP WEALTH ADVISOR, MARK CORTAZZO

How not to run out of money in retirement with leading financial advisor Mark Cortazzo.

WATCH NOW…

FAANG STOCKS DOMINANCE

NEW THIS WEEK… Thornburg Value Fund’s Connor Browne was an early investor in Google and Facebook and at various points has owned Amazon and Netflix. What’s his view of these industry disruptors now? Will they continue to innovate and dominate? Browne brings us up to speed on the state of their market and technology evolution.

LEARN MORE…

DISRUPTIVE TECHNOLOGIES

NEW THIS WEEK: Keeping track of myriad disruptive technologies shaking up businesses and the markets is a daunting task, requiring familiarity with multiple disciplines, industries, and global markets.

Public television’s spring fundraising drive is underway which means we’re revisiting an annual WEALTHTRACK tradition: Nine years after the Great Recession why is global growth accelerating?

FINANCIAL SMARTS: JONATHAN CLEMENTS’ TIPS TO RAISE FINANCIALLY SAVVY CHILDREN

NEW THIS WEEK:

How do you raise financially responsible children in an instant gratification, consumer-oriented culture? Award-winning personal finance journalist Jonathan Clements shares his common sense How to Think About Money approach.

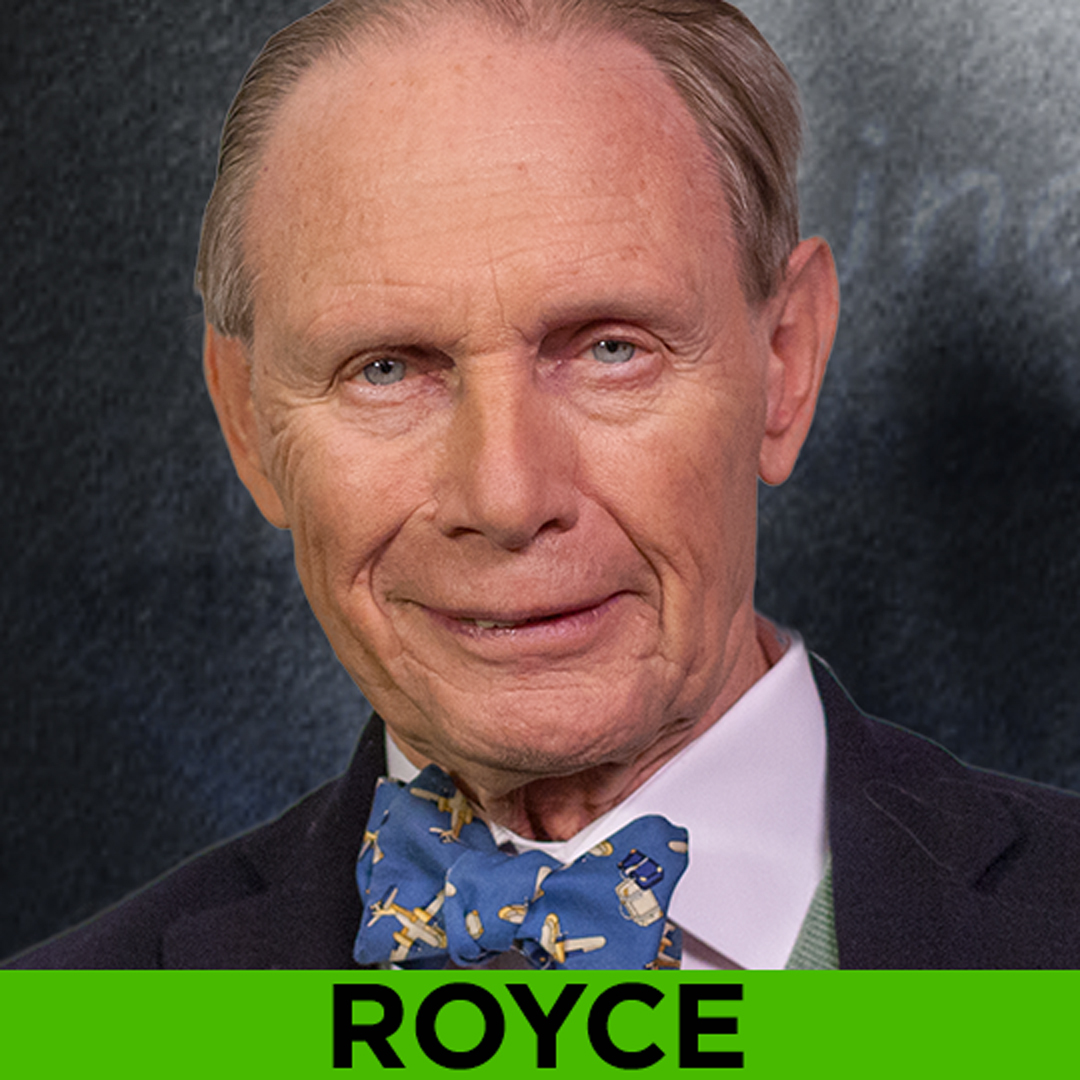

RICH UNIVERSE: LEGENDARY INVESTOR CHUCK ROYCE IS FINDING NUMEROUS OPPORTUNITIES OVERSEAS IN SMALL CAP STOCKS

A rare interview with small-cap pioneer Chuck Royce on the evolving international and income opportunities in small company stocks.