Why do investors make stupid mistakes? Why do individuals consistently underperform the very funds they invest in? Are there strategies investors can follow to avoid self-destructive behavior? Those are some of the weighty questions Financial Thought Leader Andrew Lo is trying to answer from two vantage points, one as a professor of Finance at MIT and Director of its Laboratory for Financial Engineering, the other as strategist and fund manager at his firm AlphaSimplex Group. This week’s conversation will start with his most recent research project at MIT, titled “Artificial Stupidity”!

Special Series

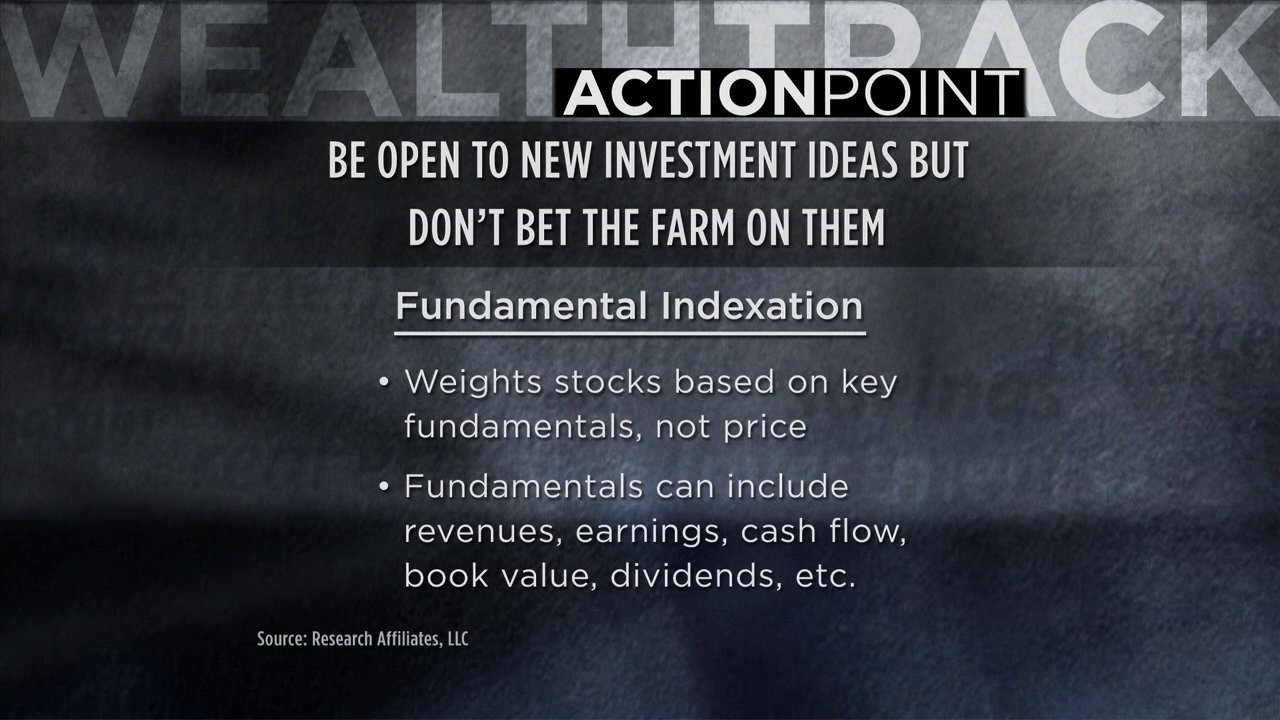

ROBERT ARNOTT ACTION POINT

Be Open To New Investment Ideas But Don’t Bet The Farm On Them -Fundamental Indexation – Weights stocks based on key fundamentals, not price. -Fundamentals can include revenues, earnings, cash flow, book value, dividends, etc.

CLEMENTS & ZWEIG ACTION POINT

Treat Your Social Security As A Bond Holding For instance $21,000 of Social Security income a year is equal to holding a $700,000 portfolio of 10 Year Treasury bonds yielding 3 percent.

ROBERT SHILLER: NOBEL PRIZE WINNING ECONOMIST

Robert Shiller, recent winner of the Nobel Prize in Economic Sciences, a Yale professor and the co-creator of the Case-Shiller Home Price Indices discusses the importance of psychology in the markets and what it’s telling him now.

DANIEL O’KEEFE: MORNINGSTAR’S INTERNATIONAL STOCK FUND MANAGER OF THE YEAR

A rare interview with the 2013 and 2008 Morningstar International Stock Fund Manager of the Year! Portfolio Manager Daniel O’Keefe explains how his Artisan International Value and Artisan Global Value funds trounce the competition and the market in both bull and bear markets.

CHARLES DREIFUS – A SMALL CAP INVESTOR THINKS BIG

A WEALTHTRACK Great Investor who has made his name investing in small company stocks explains why he now favors large companies. Charlie Dreifus, the portfolio manager of the Royce Special Equity funds discusses why big is better in today’s markets.