As it’s the summer vacation season, we are re-airing a program that was of particular interest to our viewers. It’s a WEALTHTRACK exclusive with two outstanding value investors – Wally Weitz of the Weitz Funds, and Tom Russo of Gardner Russo & Gardner, together on television for the first time.

Financial Thought Leader and long-time exclusive WEALTHTRACK guest, Charles Ellis is a legend in the investment consulting business. A few years ago he had what he described as an “aha” moment, the realization that passive investing had become superior to traditional active money management for a host of reasons. He lays out his rationale in “The Rise and Fall of Performance Investing,” recently published in the Financial Analysts Journal. He is sharing it with WEALTHTRACK.

Season 11

POSSIBLE SAFE HARBORS

WEALTHTRACK is pre-empted on many public television stations this week because of summer fund raising drives, if it is pre-empted in your town, you can see it here. However, we are still keeping our eye on the rising geopolitical tensions around the world and their possible impact on financial markets. Strategas Research Partners recently sent its clients a list of investments which should benefit during times of uncertainty.

RETIREES ON TRACK

As it’s the summer fund raising season on public television, this week we are revisiting an interview with two top personal finance journalists, both now at The Wall Street Journal. Jonathan Clements and Jason Zweig tackle the three greatest financial challenges facing Americans. Watch the episode here.

New this week, we are sharing some interesting research on retirement savings. It’s from a recent T. Rowe Price survey which found that recent retirees with 401 (k)s feel on track meeting their financial goals. Some of their key findings are that retirees are living on less – on average, around 66% of their pre-retirement income. However, nearly 60% report that are living as well or better than when they were working. Almost 90% are reasonably satisfied with retirement so far and most think that are better off compared with how their parents fared in retirement.

TRENNERT: THERE IS NO ALTERNATIVE

How worried are you about the stock market? Is the near tripling of stock prices since the 2009 market bottom a cause for concern? This week’s WEALTHTRACK guest has some different and positive perspectives on the market. Jason Trennert is Managing Partner and Chief Investment Strategist of Strategas Research Partners, an independent investment strategy and macroeconomic research firm. Trennert is widely followed by institutional investors in the money management and hedge fund world, and is identified as one of “Wall Street’s Best Minds” by Barron’s. One of his most widely quoted themes is known as TINA – “There Is No Alternative” – meaning “there is no alternative to stocks right now”. We’ll ask him to explain.

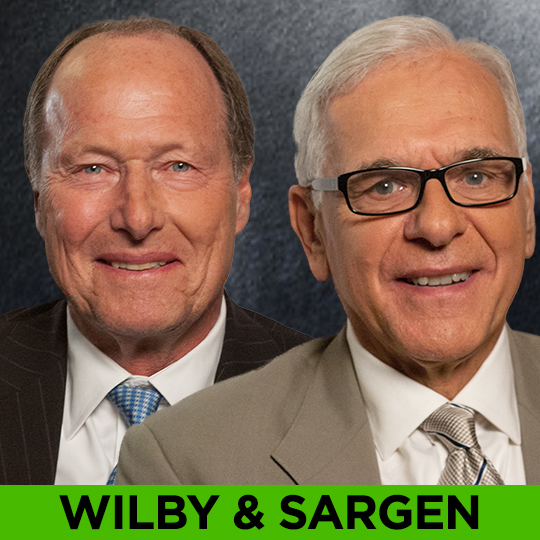

WILBY & SARGEN: GLOBAL DANGERS

How vulnerable are the markets? Despite rising geopolitical conflicts and uncertainty surrounding the Federal Reserve’s exit plan from its unprecedented monetary expansion, U.S. stock and bond markets are trading near record highs. Two veteran global investors, private investor William Wilby, formerly of number one ranked Oppenheimer Global Fund and Fort Washington Investment Advisors’ Chief Economist and Senior Investment Advisor Nicholas Sargen share their perspective and strategies.

ROBERT DOLL: MARKET ORACLE

This week’s WEALTHTRACK guest has made a name for himself with his annual predictions and with his proven investment skill. Bob Doll, Chief Equity Strategist and Senior Portfolio Manager at Nuveen Asset Management, has run several large cap stock mutual funds for three decades. We’ll get a personal take on his mid-year predictions for investment opportunities, and traps to avoid.