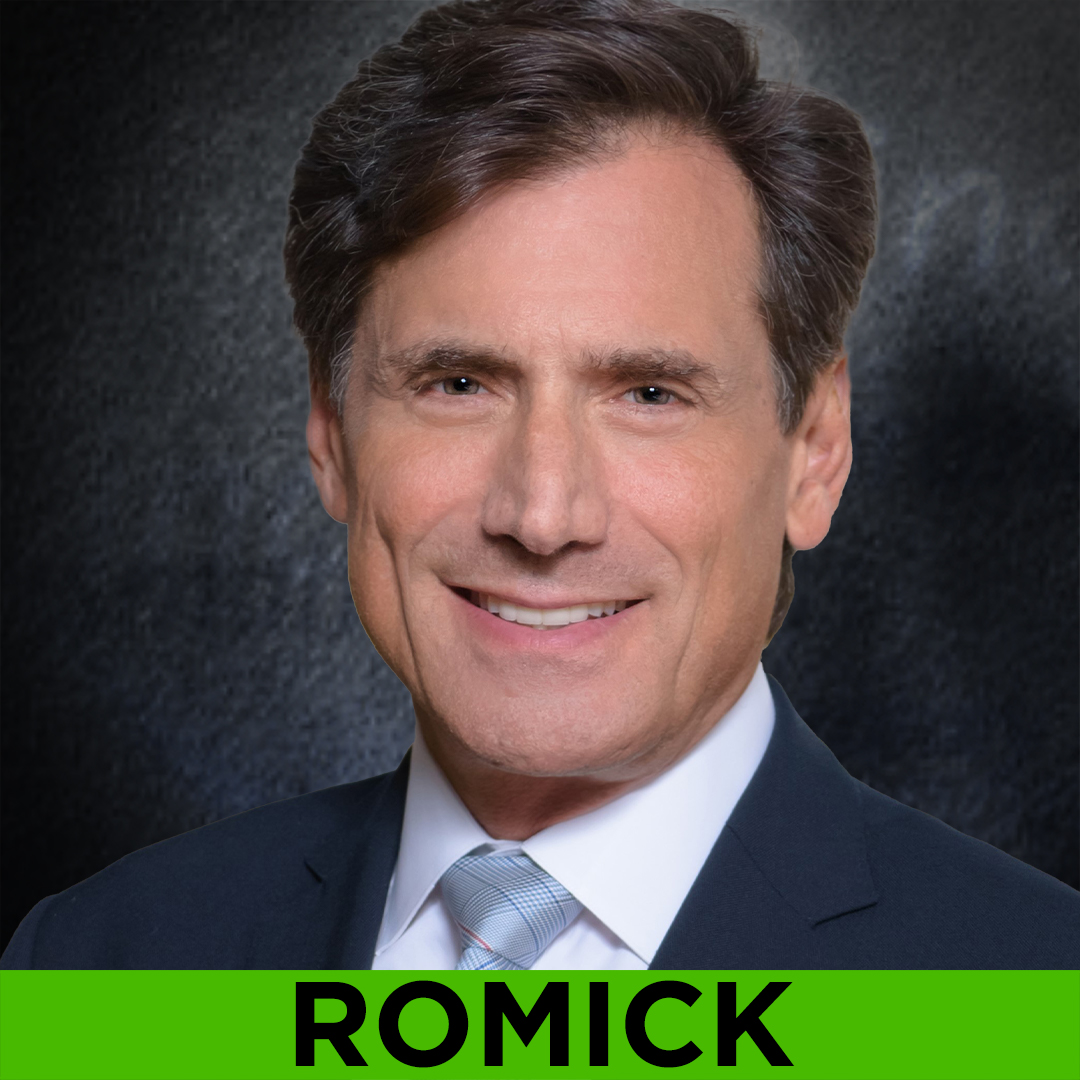

Part 2 of 2: Our rare conversation with Great Investor Steven Romick. Lessons learned from running the gold rated FPA Crescent fund for 30 years, delivering equity-like returns with far less risk.

Steven Romick

GREAT VALUE INVESTOR STEVEN ROMICK DESCRIBES FPA CRESCENT FUND’S CURRENT POSITIONING

Part 1 of 2: In a rare interview, FPA Crescent Fund’s founding portfolio manager, Steven Romick puts the fund’s current positioning into perspective as it celebrates its 30th anniversary.

GREAT INVESTOR STEVEN ROMICK LOADED UP ON UNLOVED STOCKS DURING 2020 SELL-OFF. WHAT’S HIS PLAN NOW?

FPA Crescent’s founder and portfolio manager, Steven Romick has an impressive track record of delivering equity-like returns with less than stock market risk with his contrarian investment approach. You’ll never guess what he is buying now.

WATCH NOW…

STEVEN ROMICK: CONTRARIAN CASH

Great Investor, Steven Romick, Morningstar’s 2013 Asset Allocation Fund Manager of the Year has built up one of the largest cash hordes of his career in his FPA Crescent Fund. This noted contrarian says even with his broad investment mandate of investing in any asset class, in any market the bargains are few and far between. He discusses the opportunities he is finding in farmland, real estate loans and some selective stocks

Steven Romick: Great Investor, Steven Romick, comments on the ’87 Market Crash

A rare interview with Great Investor, Steven Romick of FPA Crescent Fund. Romick describes how he is keeping his five-star rated fund on top by balancing the forces of inflation and deflation and continuing his contrarian, value-oriented strategies.

CONSIDER INVESTING IN “COMPOUNDERS”

“COMPOUNDERS” Dominant global businesses Skilled at reinvesting capital Margin of safety Some “compounders” in the FPA Crescent Fund: AON (AON), WPP (WPPGY), Unilever (UNLYF) AON data by YCharts Watch this episode here.