Making money by losing less is how legendary small-cap value manager Charlie Dreifus has succeeded for over 50 years of investing. It’s even more important now as he expects more economic and market pain ahead.

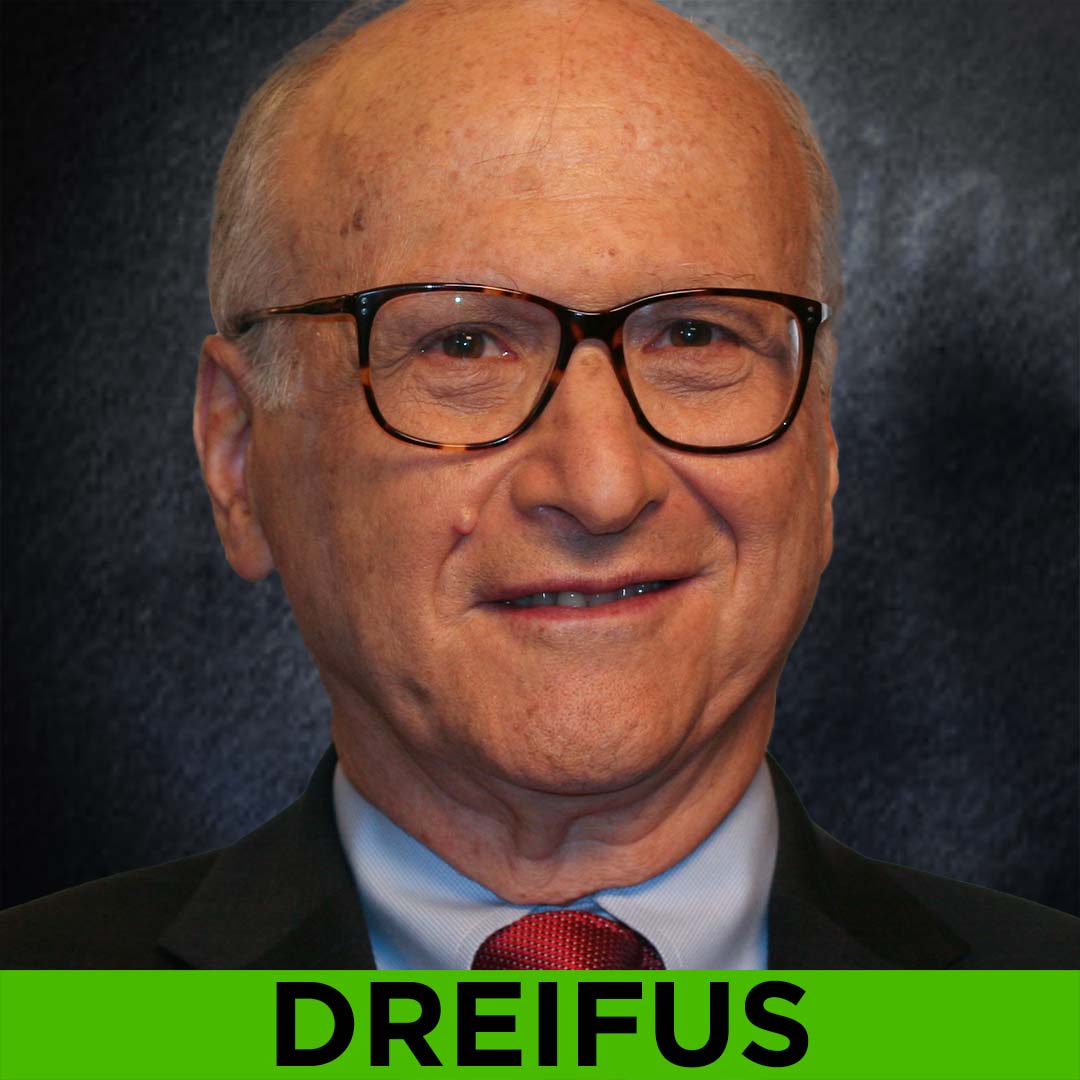

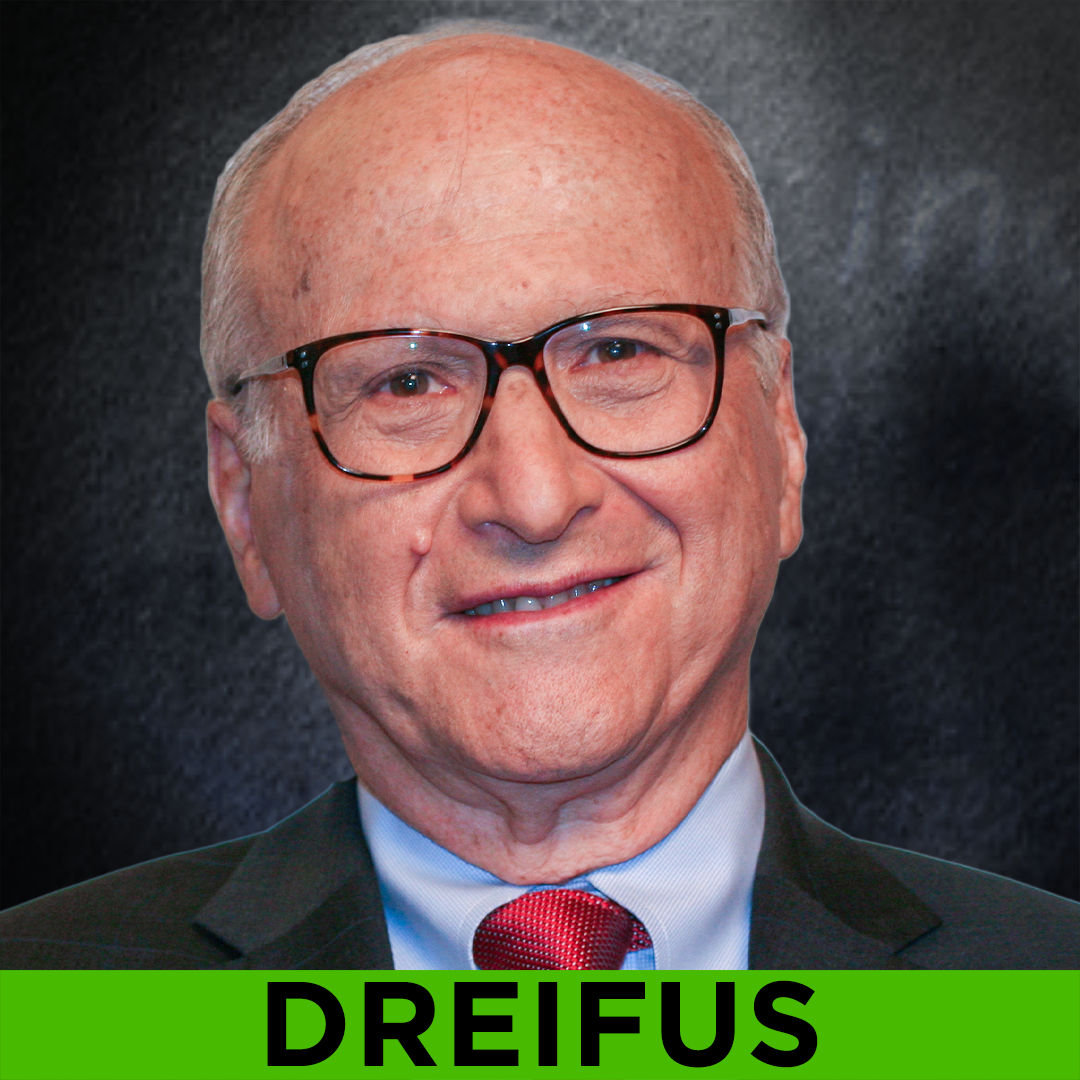

Charles Dreifus

ROYCE SPECIAL EQUITY FUND’S LEGENDARY CHARLIE DREIFUS EXPLAINS HIS “WINNING BY LOSING LESS” STRATEGY

Legendary investor Charlie Dreifus’ half a century of deep-dive accounting work has helped him build focused portfolios that beat the market over multi-year periods by losing less.

VETERAN SMALL CAP VALUE MANAGER CHARLIE DREIFUS IS STICKING WITH HIS CONTRARIAN RISK AVERSE APPROACH

Small Cap value investor, Charlie Dreifus on why value has been badly lagging growth.

WATCH NOW…

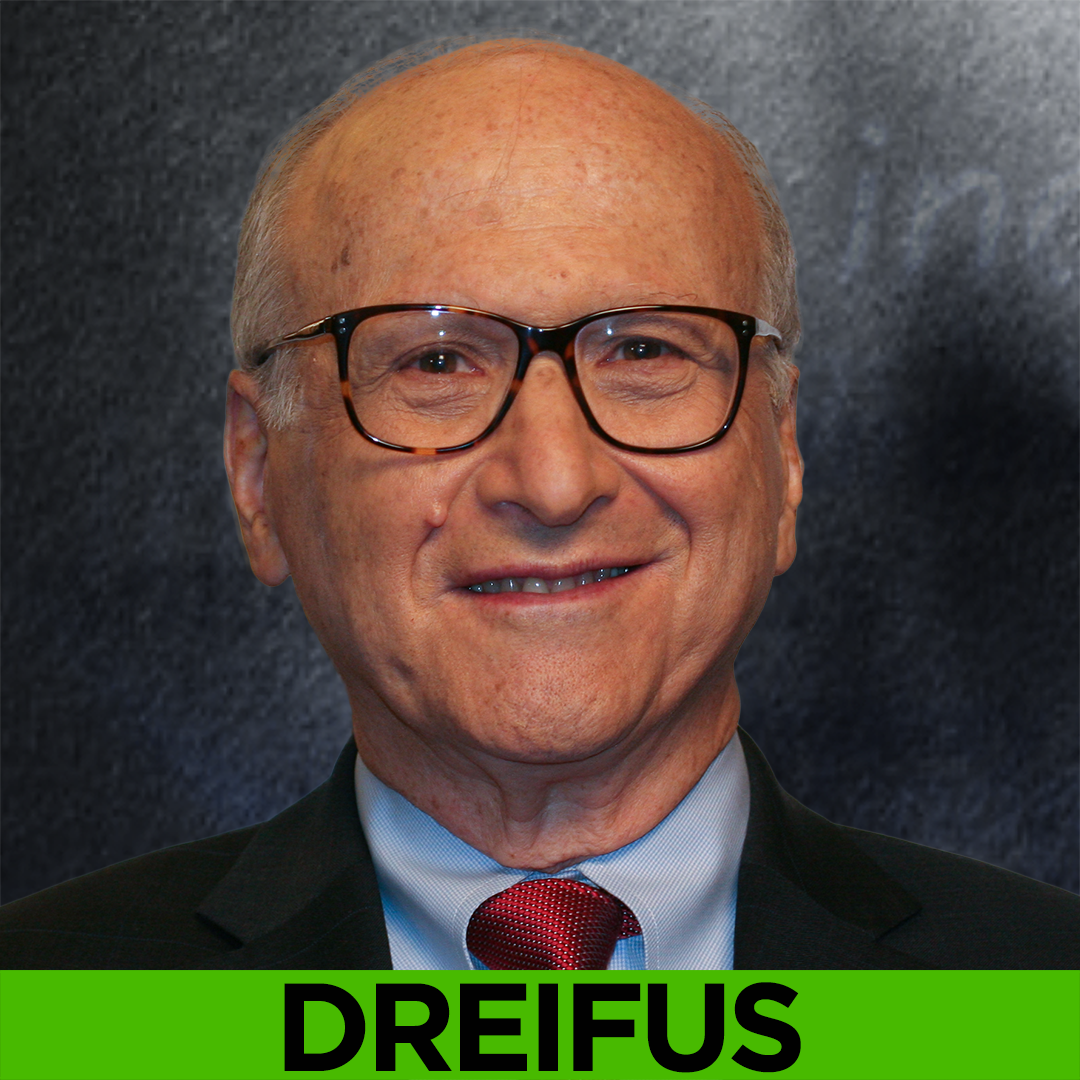

DREIFUS: PRINCIPLED ACCOUNTING

PRINCIPLED ACCOUNTING Royce Special Equity Fund’s legendary value manager Charlie Dreifus is known for his deep dive accounting, going through company finances with a fine tooth comb to identify financial weaknesses and strengths. It’s a skill and passion he learned from his mentor, award-winning accounting professor Abraham “Abe” Briloff, a renowned forensic accountant known for […]

PRICED TO PERFECTION: AFTER A 30% PLUS GAIN, VALUE INVESTOR CHARLIE DREIFUS CAUTIONS THE MARKETS ARE EXPENSIVE AND ITS TIME TO “DE-RISK” PORTFOLIOS

Small company stocks roar back! Will the rally last? An exclusive interview with a great small cap investor, Royce Special Equity Fund’s Charlie Dreifus.

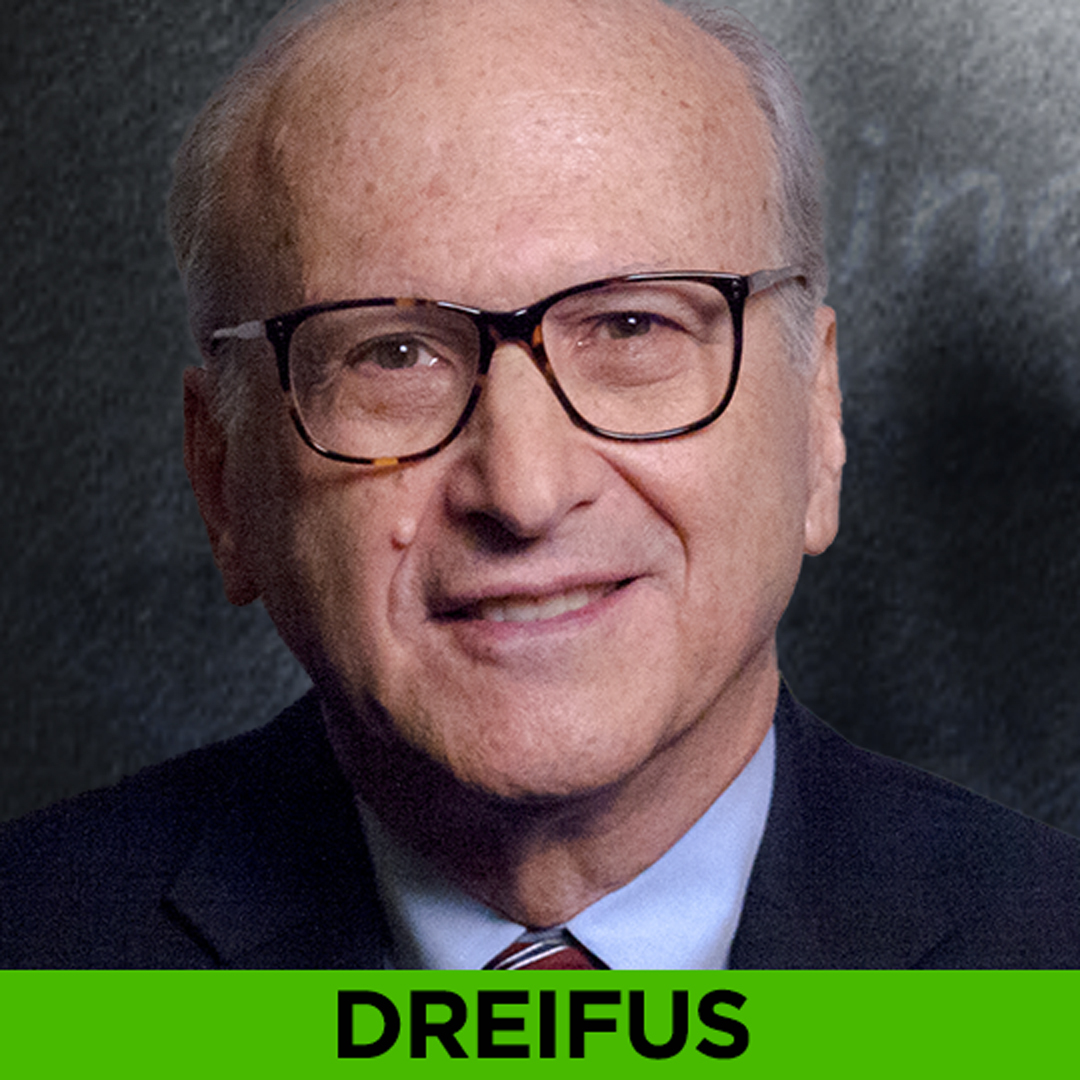

DREIFUS: SLEEPING COMFORT

SLEEPING COMFORT Great value investor Charlie Dreifus follows an investment rule for himself and recommends the same to others. He calls it: “Investing to your sleeping comfort.” Watch the related WEALTHTRACK episode.