Bob Doll has always worn two hats, one as a strategist and the other as a portfolio manager of large-cap stock funds, roles he continues today at Nuveen Asset Management. The only difference is that he is now overseeing nine large cap mutual funds under the Nuveen name. In addition to his “Traditional” large cap […]

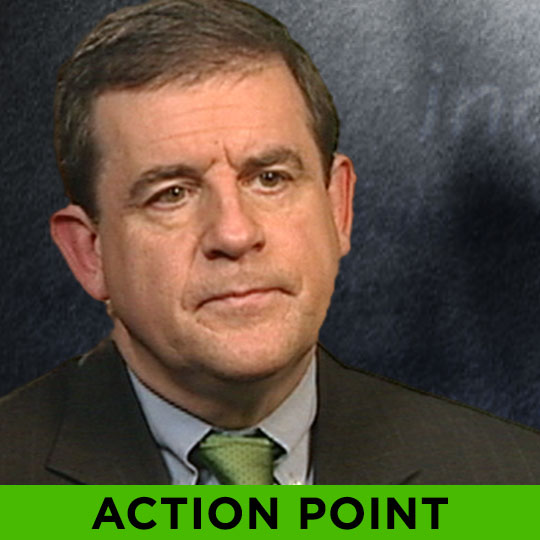

Bob Doll

ROBERT DOLL: MARKET ORACLE

This week’s WEALTHTRACK guest has made a name for himself with his annual predictions and with his proven investment skill. Bob Doll, Chief Equity Strategist and Senior Portfolio Manager at Nuveen Asset Management, has run several large cap stock mutual funds for three decades. We’ll get a personal take on his mid-year predictions for investment opportunities, and traps to avoid.

MATCH YOUR INVESTMENT STRATEGY WITH YOUR OBLIGATIONS

Consider expenses to cover & consider time frame needed Near term liabilities = stable, less risky investments Long term obligations= allocation to more risky investments providing growth over longer time frame Watch this Episode

BOB DOLL: BULLISH ON STOCKS

Bob Doll is a widely followed strategist and portfolio manager, an unusual combination at major Wall Street firms, who has excelled in both disciplines. We began the interview by asking Bob to step way back from the noise of the day and share his longer term views of where we are and where we are heading. My first question was why, after the worst decade since the 1930’s, he is predicting that stock returns in this decade will be in the high single digits.

ED HYMAN AND BOB DOLL

An exclusive interview with Wall Street’s long time number one economist Ed Hyman and Great Investor Bob Doll. What they expect in the economy and markets in 2012 and strategies to prosper in it.

WATCH NOW…

BOB DOLL, JOHN MONTGOMERY AND TOM PETRIE

Three outstanding financial world figures: Bob Doll runs three large cap funds at BlackRock; John Montgomery heads up a family of funds using computer models at Bridgeway Capital; Tom Petrie, Vice Chairman of Bank of America – Merrill Lynch, is a veteran observer of the energy sector