A few weeks ago a WEALTHTRACK interview with legendary value investor Bill Miller garnered a tremendous amount of interest because he talked about his outsized position in bitcoin in his personal portfolio. Now that bitcoin has dropped more than 20% year to date, what’s he been doing?

READ NOW…

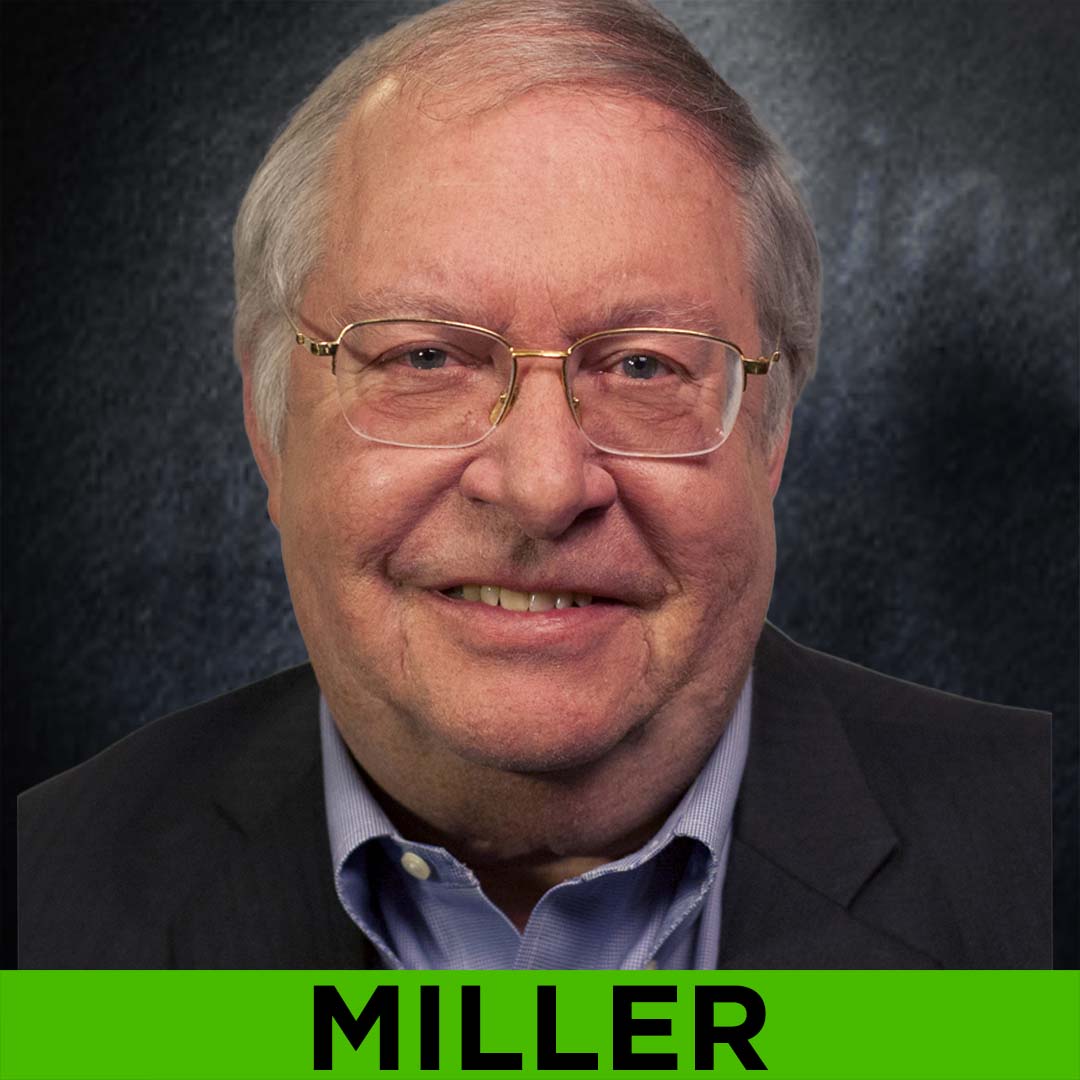

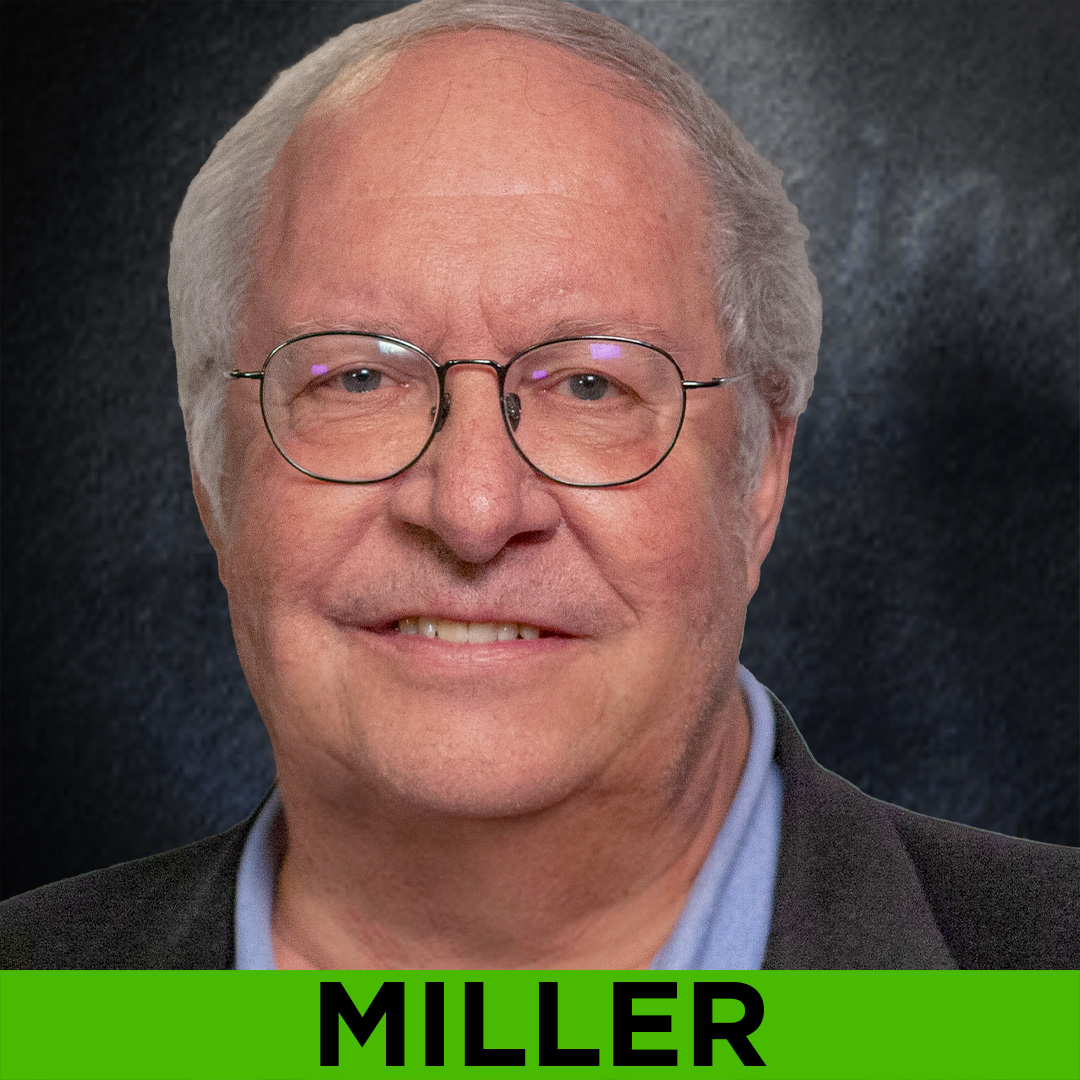

Bill Miller

RISING INFLATION, INTEREST RATES & EXPENSIVE MARKETS CALL FOR REASSESSING RETIREMENT PLANS

Morningstar’s personal finance guru Christine Benz says rising inflation, interest rates, early retirements, and expensive markets call for some fundamental changes in retirement planning.

WATCH NOW…

INVESTMENT LEGEND BILL MILLER HAS 50% OF HIS PERSONAL PORTFOLIO IN BITCOIN & RELATED INVESTMENTS

Part 2 of 2

Legendary stock fund manager Bill Miller explains why 50% of his personal portfolio is in bitcoin and related investments

WATCH NOW…

GREAT VALUE INVESTOR BILL MILLER DISCUSSES HIS CORE HOLDING WINNERS AND RECENT PROMISING ADDITIONS

Part 1 of 2

Great value investor Bill Miller remains the only fund manager to beat the market for 15 consecutive years. He discusses his current core holding winners and some recent promising additions to his legendary portfolio.

A RARE IN-DEPTH INTERVIEW WITH GREAT INVESTOR BILL MILLER ON WHAT THE PANDEMIC HAS CHANGED

Legendary investor Bill Miller on what the pandemic has and has not changed.

WATCH NOW…

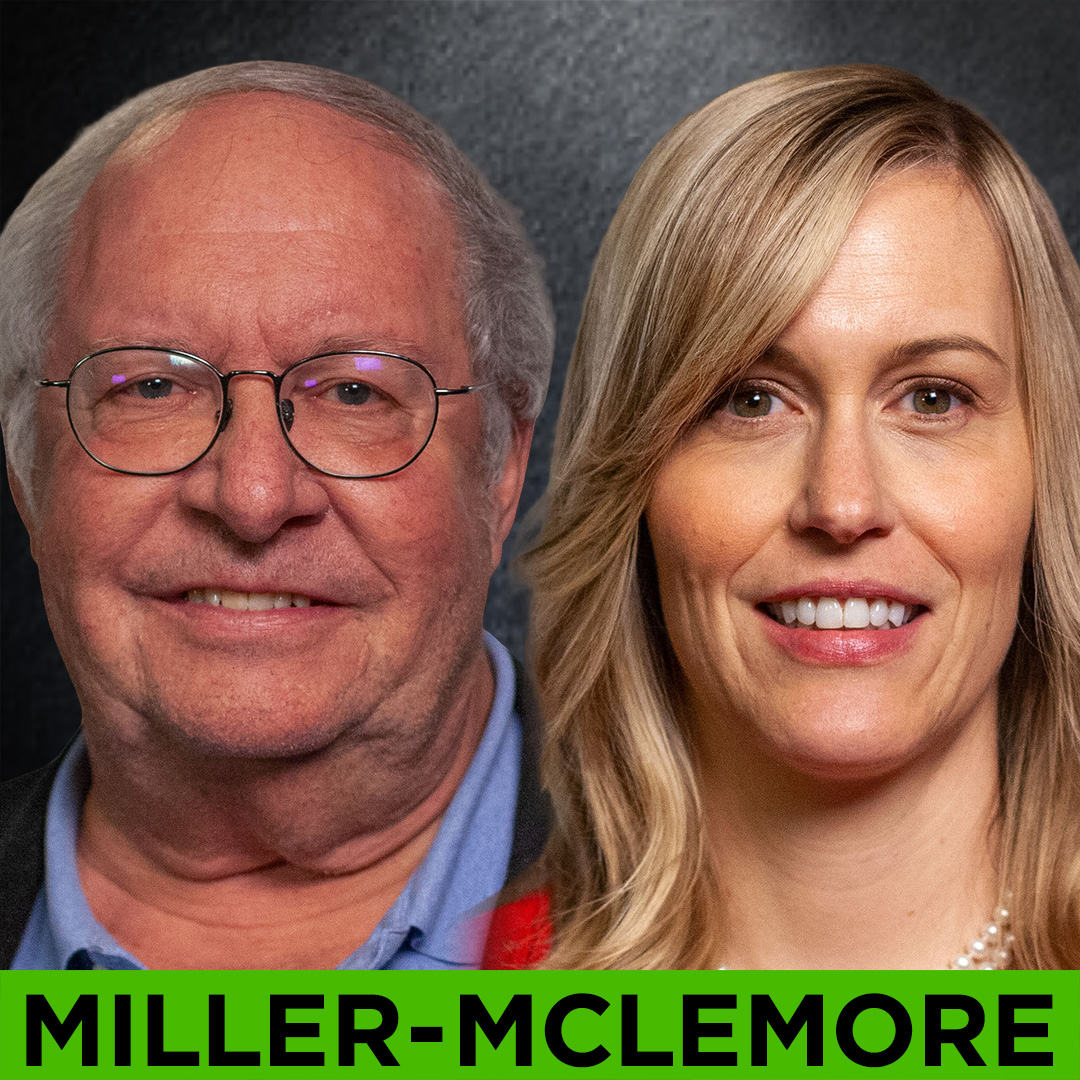

MARKET BEATING VALUE INVESTORS: THE NEXT GENERATION

Consuelo Mack WEALTHTRACK launches a new season with its “Next Generation Investors” series featuring an exclusive interview with legendary value investor Bill Miller, and Samantha McLemore, his Co-Portfolio Manager on the Miller Opportunity Trust fund.