Donald Yacktman, President and Founder of Yacktman Asset Management runs two five-star funds. Both have beaten the markets and their peers by wide margins over the years. This past Morningstar Stock Fund Manager of the Year explains while his approach to picking stocks has stayed the same, his current strategy is changing.

Cisco

ROBERT KLEINSCHMIDT: WALL STREET “TROUBLE MAKER”

Robert Kleinschmidt, long-time Portfolio Manager of the Tocqueville Fund and a well-known contrarian on Wall Street. He was bullish on stocks when every one was calling for the death of equities. He pooh poohed the effect the election and the fiscal cliff would have on the market. Now he has a very contrarian view of the Fed’s unprecedented policy to keep interest rates low.

ROBERT SHEARER: SEARCHING FOR GOOD DIVIDEND STOCKS

Why not all dividends are created equal. Robert Shearer, lead portfolio manager for BlackRock’s Equity Dividend Fund explains why some dividends are better than others and where he is finding the best in growth and income.

Bill Miller: Where is he investing now?

A TV exclusive with legendary value investor Bill Miller. The only mutual fund manager to beat the S&P 500 for 15 years in a row, Miller’s Legg Mason Capital Management Opportunity Fund was the number one mutual fund last year. Where is he investing now? Find out!

BOB DOLL: BULLISH ON STOCKS

Bob Doll is a widely followed strategist and portfolio manager, an unusual combination at major Wall Street firms, who has excelled in both disciplines. We began the interview by asking Bob to step way back from the noise of the day and share his longer term views of where we are and where we are heading. My first question was why, after the worst decade since the 1930’s, he is predicting that stock returns in this decade will be in the high single digits.

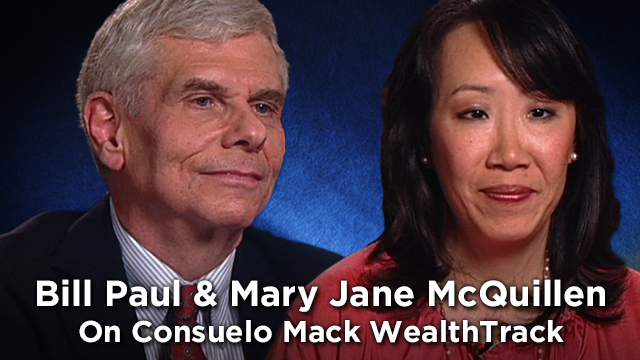

Mary Jane McQuillen & Bill Paul

We are kicking off a new season of WEALTHTRACK with the first of a two part series devoted to what’s being called “impact investing,” the practice of aligning financial goals with personal values. Impact investing goes beyond what used to be called socially responsible investing, which was designed to avoid certain businesses such as gambling, alcohol and tobacco. It is now pro-active as well, investing in companies that are making a positive impact in a wide range of areas including environmental, societal and governance (ESG).