Two investing legends come together in an exclusive television interview this week! ISI Group’s Ed Hyman, Wall Street’s number one ranked economist for 34 years running, is joined by Legg Mason’s history-making portfolio manager Bill Miller to discuss their top investment forecasts and strategies for 2014.

ED HYMAN & BILL MILLER – PART I – INVESTMENT LEGENDS’ PREDICTIONS FOR 2014

AVOID THE UNDERPERFORMANCE TRAP

AVOID THE UNDERPERFORMANCE TRAP Investors chase performance: buy when funds are hot and sell when they cool off How to avoid the underperformance trap? Invest with a fund manager who suits your investment style. Don’t chase performance Buy incrementally

RUSSO & WEITZ – DYNAMIC VALUE DUO

An exclusive get-together with two outstanding value investors! Wally Weitz, whose flagship Weitz Partners Value Fund is celebrating its thirty year anniversary, and Tom Russo, with his market-beating Semper Vic Partners Fund, will discuss the different places each is finding value and why Warren Buffet is their investment hero.

MAKE SURE YOU HAVE SOME “BORING” INVESTMENTS IN YOUR PORTFOLIO

[bliptv id=”h_Btg5ntfgA”]

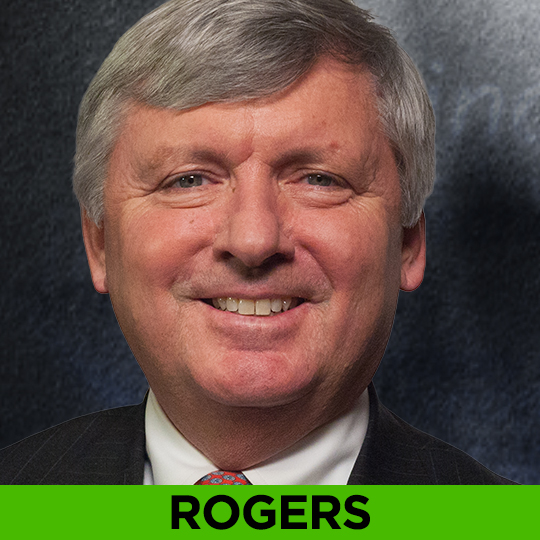

BRIAN ROGERS: CONSIDER REBALANCING YOUR PORTFOLIO

CONSIDER REBALANCING YOUR PORTFOLIO – Trim overvalued winners – Add to undervalued laggards Stock Portfolio Potential trims: U.S. stocks, especially small cap stocks Potential adds: Emerging market stocks Bond Portfolio Potential trims: High yield bond winners Potential adds: Short term Treasury notes and T-bills High quality emerging market government and corporate bonds

BRIAN ROGERS – NOTHING IS CHEAP

“What if nothing is cheap” in today’s market? In a rare interview, Brian Rogers, longtime portfolio of the T. Rowe Price Equity Income Fund, a Morningstar favorite, tells us why he’s worried about risks and “pockets of craziness” in the market and where he is finding value in an expensive world.