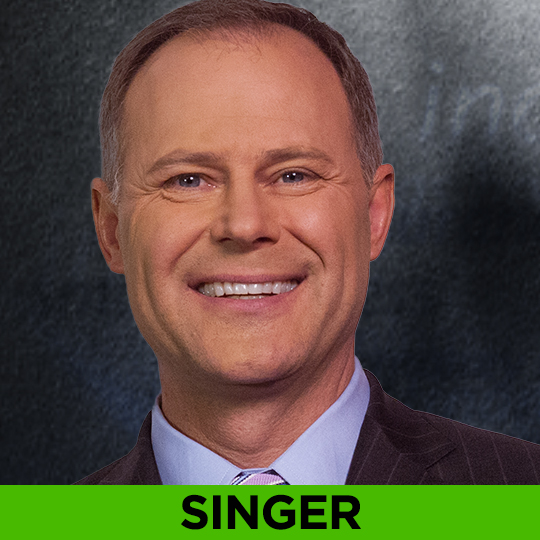

Why are events in Greece and China so important to investors? In a rare interview, top performing, five-star rated Portfolio Manager, Brian Singer of the William Blair Macro Allocation Fund explains why macro matters.

Season 12

MAXIMIZING MEDICARE, PLUS WOMEN INVESTORS

It’s the final week of the summer fund-raising drive on Public Television, so we are revisiting some of our most popular programs. An estimated 95% of seniors pay too much for Medicare. Healthcare expert Katy Votava, president of Goodcare.com and author of “Making the Most of Medicare” explains what you need to know to maximize those benefits and avoid overpaying.

New this week, Here’s a thought provoking finding: during the financial crisis and the post-crisis years, hedge funds run by women have significantly outperformed the broader market of hedge funds, the vast majority of which are run by men. This is one of the many fascinating facts found in a report “Addressing Gender Folklore” from the State Street Center of Applied Research.

SMEAD: A CONTRARIAN ON CHINA – PLUS, POWERFUL CENTRAL BANKERS

The summer fund raising season for Public Television continues this week so we are revisiting some shows that provide a different perspective and a greater understanding of trends affecting our financial lives. Who better than a student of central bank history? Liaquat Ahamed, the Pulitzer Prize winning author of Lords of Finance, discusses the differences and similarities between central bank policies today and those leading up to the Great Depression.

New this week, more on China! Last week, we shared a long-term bullish view on China from veteran China-hand, Andy Rothman of Matthews Asia funds. This week, an opposing view – some research from contrarian value investor, Bill Smead.

ROTHMAN: A CHINA BULL – PLUS, ACHIEVABLE RETIREMENT PLANNING

As the summer fund-raising season starts this week on Public Television, we are going to revisit a popular topic – retirement! We’ll hear from highly-regarded financial advisor, Jonathan Pond. He has some simple steps to see us through, no matter what the circumstances.

New this week, a special online report about China. The world’s second largest economy has gone from investment darling to pariah in just a few short weeks. Where Chinese economic statistics used to be given the benefit of the doubt, they are now widely disbelieved by many professional investors.

RYON & FRIDSON: RELIABLE RETIREMENT INCOME

Believe it or not, both short and long term interest rates are at a 5,000 year low. And no, that is not a typo. No wonder there is a global search for income! We are discussing how to find reliable income producing investments for retirement. Thornburg Investment’s Five star rated municipal bond manager, Chris Ryon and fixed income guru Martin Fridson reveal their secure income strategies.

DOLL: BIG BUSINESS

How expensive are large company U.S. stocks, the cornerstone of just about everyone’s retirement portfolio? Nuveen’s widely followed Chief Equity Strategist and large cap mutual funds manager, Robert Doll says there are high quality, dividend paying businesses worth owning for long-term value and income.