“Ignore the crowd” is the motto of this week’s Great Investor guest and Fairholme Fund’s Bruce Berkowitz. Berkowitz, who rarely sits for television interviews, said on WEALTHTRACK that he had his work cut out for himself, defending Fairholme Fund’s losing record last year.

RECENT PROGRAMS

David Winters:The Optimist Portfolio Manager

Central bankers are clearly worried about global growth. From the U.S., to Europe, to Asia, we have seen unprecedented levels of easing in recent weeks. By independent research firm ISI Group’s count, there have been more than 250 stimulative policy initiatives announced over the past 13 months. The firm also points out that we are less than 100 days from the famous fiscal cliff in the U.S., when numerous Bush era tax cuts expire and automatic spending cuts take effect if Congress and the White House can’t reach a budget compromise. If they don’t, estimates are that GDP growth could be reduced by as much as 3.5%, sending the economy into recession.

James Grant: The Federal Reserve’s Most Outspoken Critic

Federal Reserve Chairman Ben Bernanke has been widely credited with playing a key role in saving the global financial system from spiraling into a deeper recession. As a recent Financial Times headline read, “Central Bank Action Lifts Gloom”; “Bold Fed and ECB Moves Cheer Investors- Confidence Increases in U.S. and Europe.” There is no question […]

Matt McLennan: The Collision of Macroeconomic Tectonic Plates

Have the financial markets become more stable? Is a sense of equilibrium returning to the global financial system? Several widely followed measures would seem to indicate yes.

David Darst: Should You Trust the U.S. Financial Markets?

Financial Thought Leader, David Darst, Chief Investment Strategist at Morgan Stanley, where he criss-crosses the globe advising clients. He is also an acknowledged expert in asset allocation and a prolific author. Among his most recent books is a best seller, The Little Book That Saves Your Assets, which I highly recommend. I began the interview by asking David, given recent events, why should investors trust the financial markets.

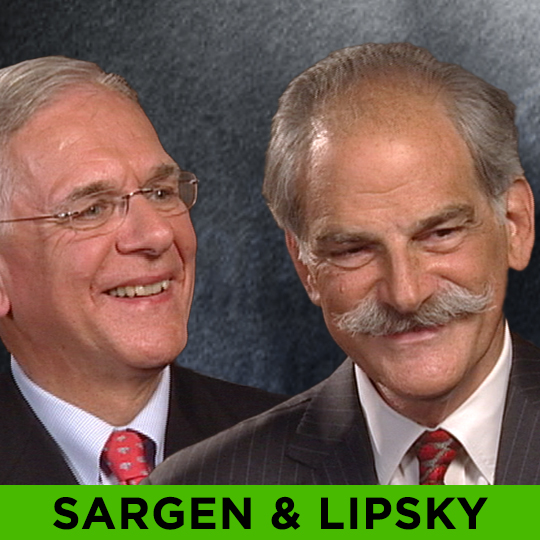

SARGEN & LIPSKY: THE DECLINE OF U.S. FINANCIAL DOMINANCE

It has been four years since the start of the worst financial crisis in the post war era. It feels like a lifetime to me. Lehman Brothers filed for bankruptcy in September 2008, tipping the world into a systemic financial meltdown which we have been recovering from ever since. It’s helpful to step back every once and while and see how far we have come since the market lows of March 2009, when the S&P closed under 700. It has more than doubled since then, but oh what a ride it has been!