Yacktman, the legendary founder of the 5 star rated Yacktman and Yacktman Focused Funds recently promoted a long time co-portfolio manager of both funds to his former Chief Investment Officer role. The portfolio manager just happens to be his son Stephen who has been with the firm for 20 years.

Guests

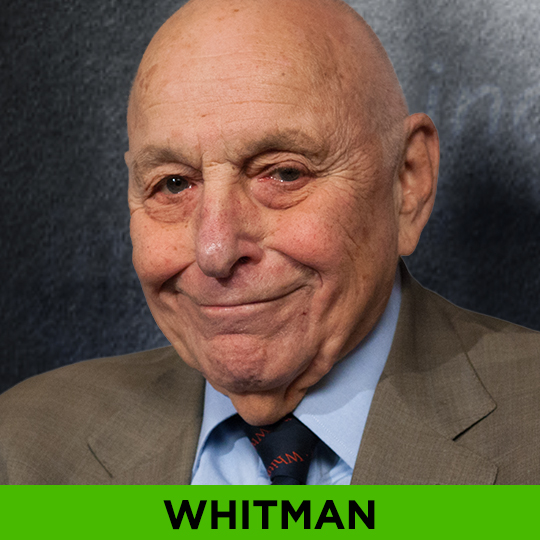

MARTIN WHITMAN: “SECOND CLASS” ROOTS

Third Avenue Management’s Founder and Chairman Marty Whitman has had enormous professional success as a deep value investor, but as a Jewish kid from the Bronx he once described feeling like a second class citizen for the first half of his life. How that has influenced him? We asked him.

MARTIN WHITMAN: THEY JUST DON’T GET IT!

They just don’t get it! That’s the view of legendary deep value investor Martin Whitman, Founder and Chairman of Third Avenue Management. In this exclusive interview taped at the Museum of American Finance, Whitman takes on Congressional and Wall Street ignorance about debt, credit worthiness, and earnings. Whitman will also discuss his long term mantra, to buy “safe and cheap” stocks, and his four elements to getting growth at dirt cheap prices.

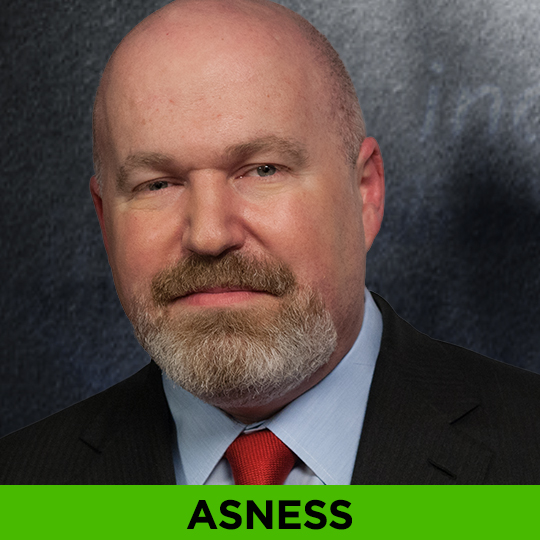

CLIFF ASNESS: LEVERAGE. DERIVATIVES. SHORTING.

The three “dirty words” of finance became taboo after the 2008 financial crisis, but this week’s guest says investors need them to boost their portfolios and “clean up” in the market. Our Financial Thought Leader this week is Cliff Asness, Managing and Founding Principal of AQR Capital Management, a global investment management firm which runs hedge funds, mutual funds, and a diversified collection of investment strategies. In this rare interview, he’ll discuss the tools we can use to diversify our portfolios.

CLIFF ASNESS: LESSONS IN RISK CONTROL

Cliff Asness, the Founding and Managing Principal of AQR Capital Management, is also the proud father of two sets of twins. Consuelo asked him if his risk managing skills from his office are also applied to his household.

DAVID ROSENBERG: SEISMIC INVESTMENT SHIFT

Financial Thought Leader David Rosenberg is predicting a generational investment shift. He explains his new call and why investors should be making some proactive changes to their portfolios now.

WATCH NOW…