Is the stock market overvalued? Is the Fed about to change course? Are investors too optimistic? What place if any should gold have in your portfolio? Those are some of the questions Consuelo will ask Morgan Stanley’s David Darst in a wide ranging interview.

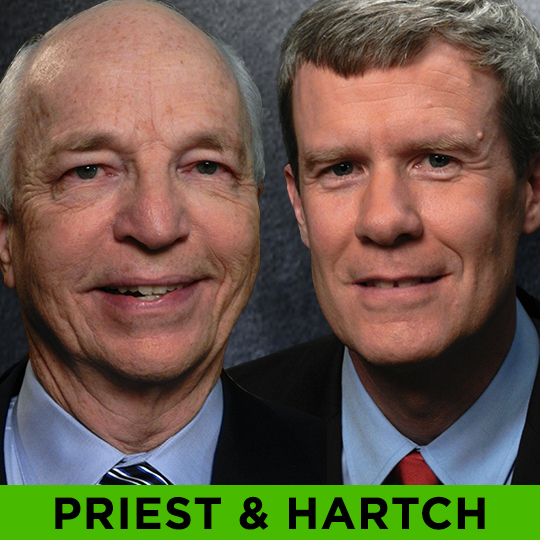

HARTCH & PRIEST: AWARD WINNING MANAGERS, CONTRASTING STRATEGIES

Epoch Investment Partners’ Bill Priest searches for yield in a wide universe; Brown Brothers Harriman’s Tim Hartch keeps a narrow focus. Find out where these two global investors with world class track records are seeing opportunities now.

TWO PROS’ PERSONAL PORTFOLIOS

We ask Tim Hartch and Bill Priest about their personal investments.

ROBERT KLEINSCHMIDT: WALL STREET “TROUBLE MAKER”

Robert Kleinschmidt, long-time Portfolio Manager of the Tocqueville Fund and a well-known contrarian on Wall Street. He was bullish on stocks when every one was calling for the death of equities. He pooh poohed the effect the election and the fiscal cliff would have on the market. Now he has a very contrarian view of the Fed’s unprecedented policy to keep interest rates low.

CONSIDER SOME CONTRARIAN INVESTMENTS FOR YOUR PORTFOLIO

WHAT’S REALLY OUT OF FAVOR? Gold: a substitute for cash, universally recognized store of value U.S. Treasury Securities: shorter term treasuries offer haven against market storms. They are liquid and guarantee of principle.

PRO’S PERSONAL PORTFOLIO: NATURAL RESOURCES

What do saltwater disposal wells and gold bullion have in common? You’ll find both in the personal portfolio of Tocqueville Fund’s Robert Kleinschmidt- he explains what makes these investments attractive.