Donald Yacktman, President and Founder of Yacktman Asset Management runs two five-star funds. Both have beaten the markets and their peers by wide margins over the years. This past Morningstar Stock Fund Manager of the Year explains while his approach to picking stocks has stayed the same, his current strategy is changing.

DONALD YACKTMAN: ALL IN THE FAMILY

Yacktman, the legendary founder of the 5 star rated Yacktman and Yacktman Focused Funds recently promoted a long time co-portfolio manager of both funds to his former Chief Investment Officer role. The portfolio manager just happens to be his son Stephen who has been with the firm for 20 years.

DONALD YACKTMAN: ALL IN THE FAMILY

Yacktman, the legendary founder of the 5 star rated Yacktman and Yacktman Focused Funds recently promoted a long time co-portfolio manager of both funds to his former Chief Investment Officer role. The portfolio manager just happens to be his son Stephen who has been with the firm for 20 years.

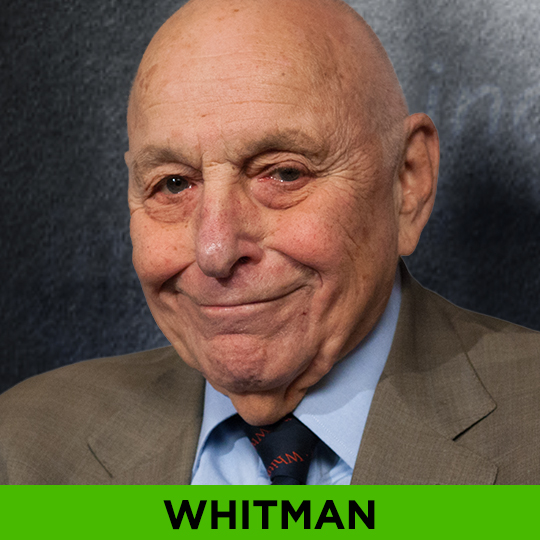

MARTIN WHITMAN: “SECOND CLASS” ROOTS

Third Avenue Management’s Founder and Chairman Marty Whitman has had enormous professional success as a deep value investor, but as a Jewish kid from the Bronx he once described feeling like a second class citizen for the first half of his life. How that has influenced him? We asked him.

THINK SAFE AND CHEAP

Whitman’s Basic Investment Rules: Buy Safe and Cheap Safe = Financially Strong Company Cheap = Buy at 30%+ discount to net asset value

MARTIN WHITMAN: THEY JUST DON’T GET IT!

They just don’t get it! That’s the view of legendary deep value investor Martin Whitman, Founder and Chairman of Third Avenue Management. In this exclusive interview taped at the Museum of American Finance, Whitman takes on Congressional and Wall Street ignorance about debt, credit worthiness, and earnings. Whitman will also discuss his long term mantra, to buy “safe and cheap” stocks, and his four elements to getting growth at dirt cheap prices.