Bob Doll has always worn two hats, one as a strategist and the other as a portfolio manager of large-cap stock funds, roles he continues today at Nuveen Asset Management. The only difference is that he is now overseeing nine large cap mutual funds under the Nuveen name. In addition to his “Traditional” large cap […]

Archives for July 2014

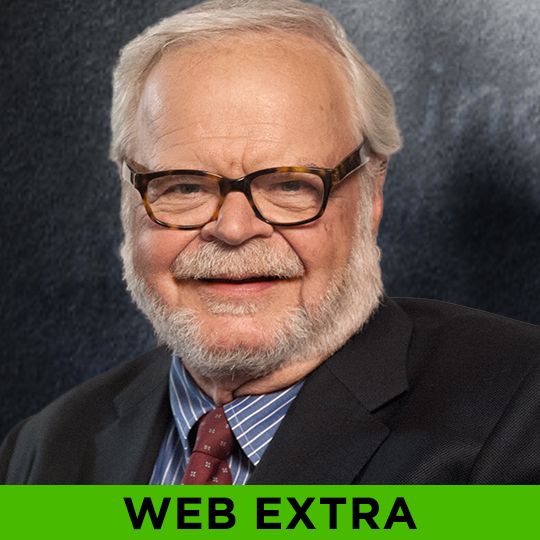

ROBERT DOLL: MARKET ORACLE

This week’s WEALTHTRACK guest has made a name for himself with his annual predictions and with his proven investment skill. Bob Doll, Chief Equity Strategist and Senior Portfolio Manager at Nuveen Asset Management, has run several large cap stock mutual funds for three decades. We’ll get a personal take on his mid-year predictions for investment opportunities, and traps to avoid.

HOW YOUR FINANCIAL PLAN CAN GO OFF COURSE

That old line about how women are from Venus and men are from Mars seems especially true when it comes to a woman’s approach to investing. For women money is part of life’s complex mosaic. They want advisors who are good listeners, even confidants.

Steven Leuthold – The Contrarian’s Contrarian

OWN SOMETHING YOU ARE UNCOMFORTABLE WITH, WITHIN REASON!

LEUTHOLD RECOMMENDS SPDR GOLD SHARES (GLD) GLD data by YCharts Watch the related WEALTHTRACK episode.

STEVEN LEUTHOLD: MUTUAL FUND EXIT

A couple of years ago Great Investor Steven Leuthold had $5 billion dollars under management and was overseeing 7 mutual funds at his old firm, The Leuthold Group, plus publishing a lengthy newsletter, View From the North Country every month. Then he decided to call it quits from the mutual fund business and launch a […]