From his early days at West Point, to his work in Military Intelligence in Vietnam and Europe, through the 12 years running his top ranked Oppenheimer Global Fund, Great Investor Bill Wilby has always kept his eyes on geopolitical risks. In my recent interview with him and Fort Washington Investment Advisors’ Nick Sargen I asked […]

Archives for July 2014

BILL WILBY: GEOPOLITICAL RISKS

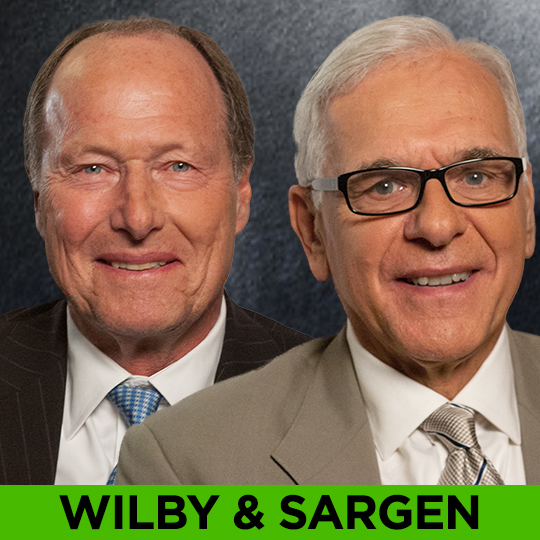

WILBY & SARGEN: GLOBAL DANGERS

How vulnerable are the markets? Despite rising geopolitical conflicts and uncertainty surrounding the Federal Reserve’s exit plan from its unprecedented monetary expansion, U.S. stock and bond markets are trading near record highs. Two veteran global investors, private investor William Wilby, formerly of number one ranked Oppenheimer Global Fund and Fort Washington Investment Advisors’ Chief Economist and Senior Investment Advisor Nicholas Sargen share their perspective and strategies.

LESS WORK AND MORE PLAY, SOME BOOKS TO READ ON YOUR SUMMER VACATION.

Lords of Finance: The Bankers Who Broke the World by Liaquat Ahamed Business Adventures by John Brooks Watch the related WEALTHTRACK episode.

Bob Doll – Market Oracle

TAKE SOME PROFITS IN YOUR TOP PERFORMERS OF THE LAST FIVE YEARS

Sell a percentage of funds or stocks that have delivered biggest gains Reinvest in lagging sectors or funds, or keep in cash Watch the related WEALTHTRACK episode.