An exclusive interview with Financial Thought Leader Charles Ellis about “what it takes” to be the best in the business. Ellis shares fifty years of wisdom learned from advising firms and governments on where to invest.

CHARLES ELLIS: BUILD A TOP PERFORMING BUSINESS CULTURE THAT LASTS

CONSIDER OWNING HIGH QUALITY SMALL CAP STOCKS

Own both U.S. and international small caps Many higher quality small cap stocks: Dominate business niche Conservatively run Pay dividends

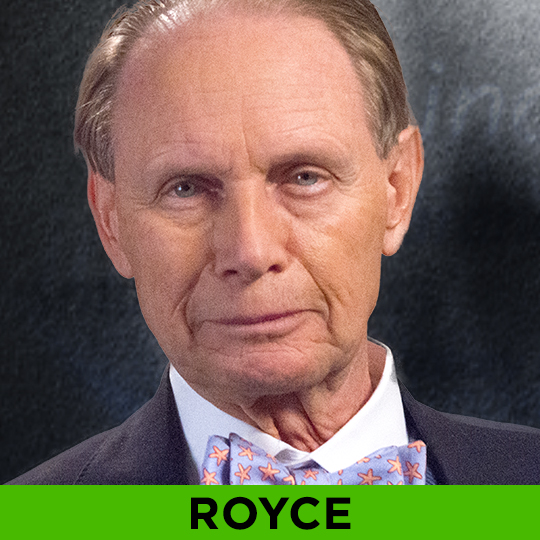

CHARLES ROYCE

An exclusive interview with small-company stock pioneer Charles “Chuck” Royce. The Royce Fund’s Great Investor shares his forty years of lessons learned in the markets, what’s changed and what still works for long-term investment success.

Ben Inker: The Next Generation of Financial Gurus

A rare interview with next generation Financial Thought Leader Ben Inker, co-head of GMO’s asset allocation team. Inker explains why he is increasing GMO’s cash levels and treading very carefully in both the stock and bond markets.

RECOGNIZE THE VALUE OF CASH IN YOUR PORTFOLIO

RECOGNIZE THE VALUE OF CASH IN YOUR PORTFOLIO Cash: Protects portfolios from losses Provides buying power when assets get cheap again

MAKE SURE YOU AND YOUR INVESTMENTS MATCH, IN SUBSTANCE, STYLE AND PERSONALITY

Over the years we have covered the distressing difference between how mutual funds’ perform and the poorer results investors in those same funds get. We call it the underperformance gap. It’s not just fees, trading costs and taxes that explain the difference: a huge factor is investor behavior. The moral to this story is: if […]