Federal Reserve Chairman Ben Bernanke has been widely credited with playing a key role in saving the global financial system from spiraling into a deeper recession. As a recent Financial Times headline read, “Central Bank Action Lifts Gloom”; “Bold Fed and ECB Moves Cheer Investors- Confidence Increases in U.S. and Europe.” There is no question […]

Special Series

Matt McLennan: The Collision of Macroeconomic Tectonic Plates

Have the financial markets become more stable? Is a sense of equilibrium returning to the global financial system? Several widely followed measures would seem to indicate yes.

David Darst: Should You Trust the U.S. Financial Markets?

Financial Thought Leader, David Darst, Chief Investment Strategist at Morgan Stanley, where he criss-crosses the globe advising clients. He is also an acknowledged expert in asset allocation and a prolific author. Among his most recent books is a best seller, The Little Book That Saves Your Assets, which I highly recommend. I began the interview by asking David, given recent events, why should investors trust the financial markets.

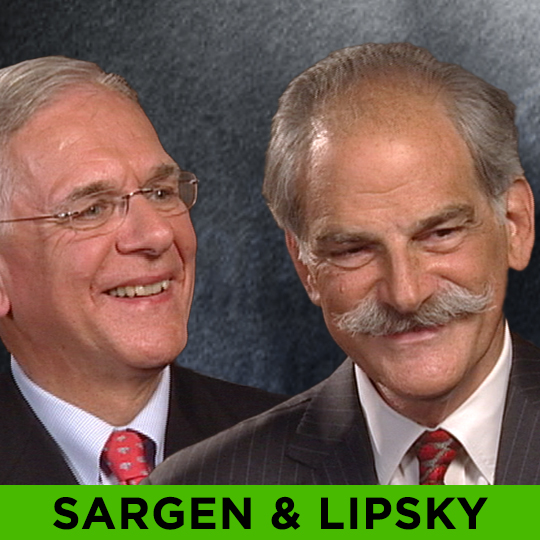

SARGEN & LIPSKY: THE DECLINE OF U.S. FINANCIAL DOMINANCE

It has been four years since the start of the worst financial crisis in the post war era. It feels like a lifetime to me. Lehman Brothers filed for bankruptcy in September 2008, tipping the world into a systemic financial meltdown which we have been recovering from ever since. It’s helpful to step back every once and while and see how far we have come since the market lows of March 2009, when the S&P closed under 700. It has more than doubled since then, but oh what a ride it has been!

Niall Ferguson (R)

The Decline of U.S. Financial Dominance We believe in having a long term perspective on WEALTHTRACK and helping our viewers and ourselves build financial security to last a lifetime. But sometimes it is necessary to step back even further and think beyond a lifetime, in terms of centuries, to really grasp the era we are […]

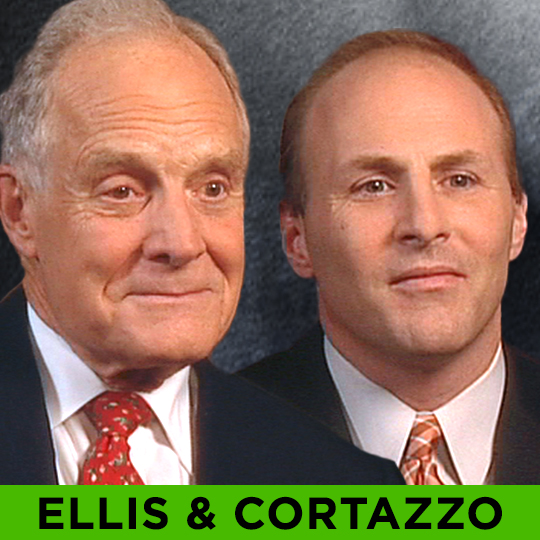

Charles Ellis & Mark Cortazzo

How much do you pay in investment fees every year? What is the actual dollar amount you pay to your financial advisor, let alone the mutual funds you own and the firms that have custody of your investments? How much do they really take away from your portfolio and its performance over the years? According to a ground breaking article by legendary financial consultant and WEALTHTRACK guest Charles Ellis, “investment management fees are much higher than you think.”