When you retire and how you invest can mean the difference between a comfortable retirement and a disastrous one. How do we go the distance in retirement without running out of money? Award winning personal finance experts, Macro Consulting Group’s Mark Cortazzo and InvestmentNews’ Mary Beth Franklin share their strategies for retirement success.

Guests

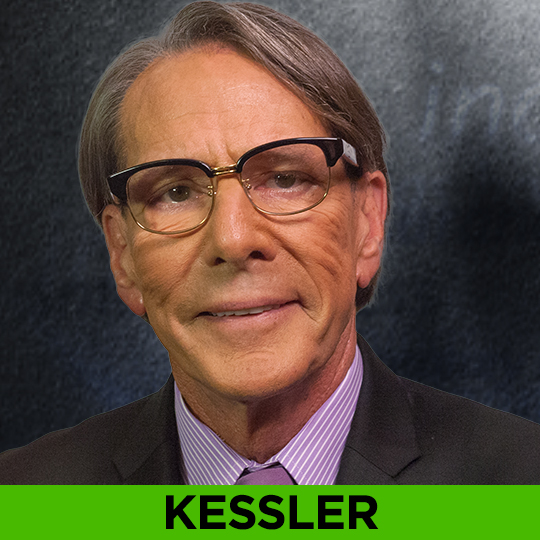

KESSLER: TREASURY BOND CONTRARIAN

Our guest is taking on the Wall Street consensus. The overwhelming sentiment from economists, analysts and strategists is that the great bond bull market, particularly in U.S. Treasuries, is over. Treasury bonds have been described as extremely overvalued, risky and undesirable. Not so says global bond manager Robert Kessler. He is sticking with his decade long, bullish view on Treasuries and says the Federal Reserve is in “no position to raise interest rates.”

WINTERS: MARKET MANIA?

As investors’ move in droves to passive, low cost index funds, one veteran money manager is sounding the alarm. Wintergreen Fund’s David Winters says index funds are a dangerous market mania, akin to other market bubbles.

HOUGAN & PERON: LOW-COST ALTERNATIVE

Investors are abandoning traditional, actively managed mutual funds in favor of “passive” index funds, particularly exchanged traded funds, or ETFs. Wall Street has taken note and is offering a wide variety of ETFs to attract investment money. How do you tell the difference between a good ETF and a bad one? When is it better to invest in an ETF? When is a traditional mutual fund the wiser choice? ETF experts Matt Hougan, CEO of ETF.com, a leading ETF research firm and Matthew Peron, head of Global Equity at giant wealth management firm, Northern Trust provide the answers you need to make the best investment decisions on this tenth season premiere.

TRENNERT: THE REAL WALL STREET

If perception is nine-tenths of reality then Wall Street has a problem. According to recent polls, just 21% of Americans view Wall Street favorably, while 33% have negative opinions. Are these feelings justified? That is the question we posed in this week’s EXTRA interview.

Our guest is Jason DeSena Trennert, Chairman of Strategas Research Partners and a 27 year Wall Street veteran of both major investment firms and independent ones. He is also the author of the just published MY SIDE OF THE STREET: Why Wolves, Flash Boys, Quants, and Masters of the Universe Don’t Represent the Real Wall Street

RUSSO: LONG-TERM VALUE

A rare interview with great value investor and Warren Buffett student Tom Russo, who invests in iconic brand name companies for the long term. Which global businesses is he most enthused about now?