START PREPARING YOUR PORTFOLIO FOR THE NEXT TEN YEARS Market leaders of one decade are frequently laggards of next and vice versa 2010s MARKET LEADERS (12/31/2009-12/31/2019) U.S. Stock Market: Large (S&P 500) +256.4% Mid (S&P 400) +230.6% Small (Russell 2000) +205.5% NETFLIX +4000% 2010s MARKET LAGGARDS (12/31/2009-12/31/2019) Emerging Markets (MSCI Emerging Markets Index) +48.3% Brazil […]

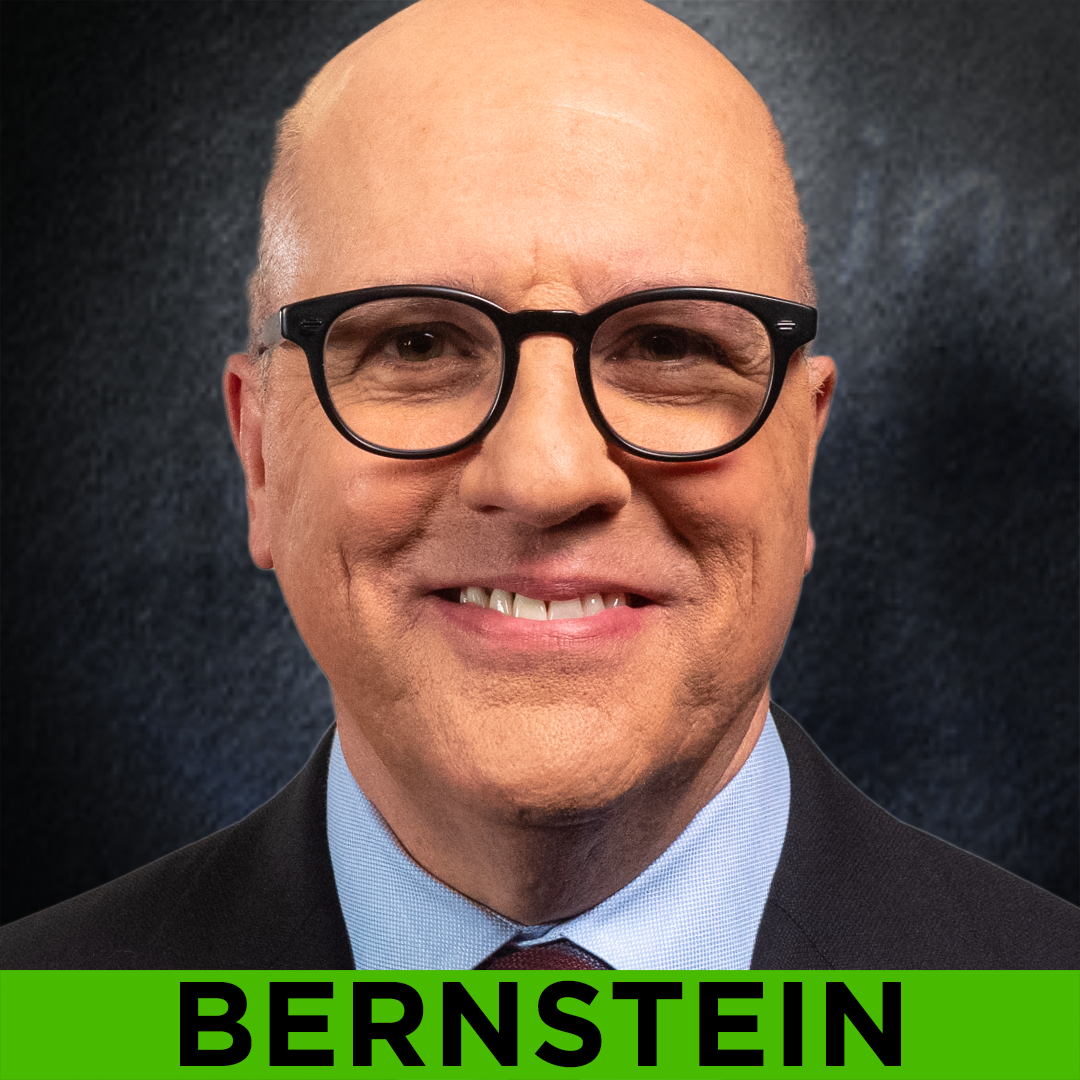

BERNSTEIN: INFRASTRUCTURE CRISIS

INFRASTRUCTURE CRISIS Richard Bernstein is known for his macro calls and asset allocation skills. He is raising the alarm about the deteriorating state of infrastructure investment in the U.S. and its consequences. Watch the related WEALTHTRACK episode.

THE END OF GLOBALIZATION IS A GAME-CHANGER FOR MARKET LEADERSHIP CREATING NEW WINNERS AND LOSERS

Are we witnessing the end of globalization, the dominant trade and economic force of the last quarter-century? That is what financial thought leader Richard Bernstein is suggesting to clients. In a recent report, aptly titled: Investing for December 31, 2029 – The End of Globalization, he makes his case.

WATCH NOW…

Mega Investment Trends Influencing Markets

This page is here for technical reasons. Please click here for the episode page.

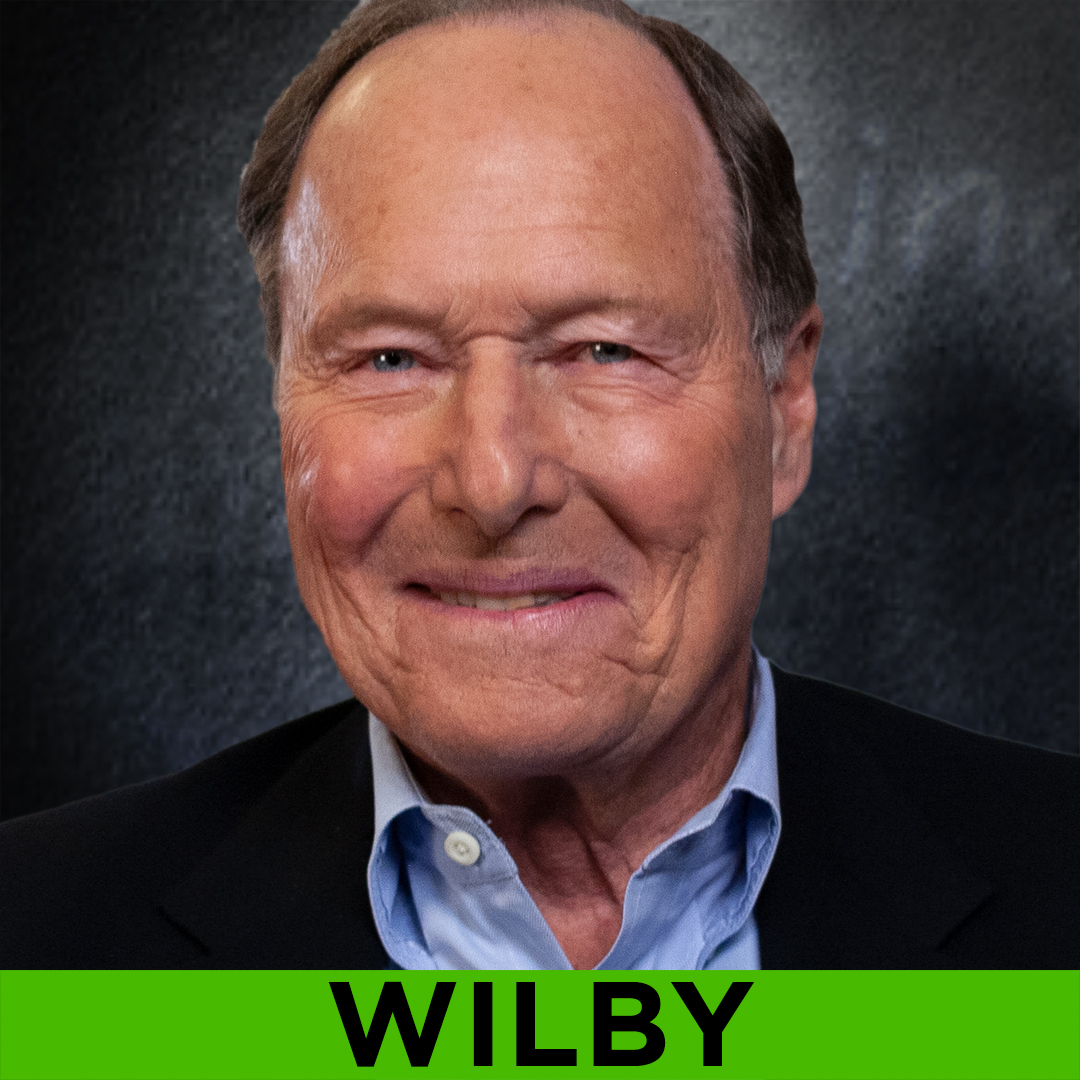

WILBY: OPTIMISTIC FUTURE

OPTIMISTIC FUTURE Private investor Bill Wilby has been traveling and reading extensively since 2007 when he retired from managing the Oppenheimer Global Fund, which was ranked the number one global fund during his twelve-year tenure. He highly recommends two recently read books. Watch the related WEALTHTRACK episode.

STICK WITH PUBLICLY TRADED SECURITIES

STICK WITH PUBLICLY TRADED SECURITIES Signs of Private Equity Trouble An explosion in the number of private equity firms: 106% increase in PE-backed companies in the decade ending 2017 Net asset value of PE holdings up sevenfold since 2002 Watch the related WEALTHTRACK episode.