What are the biggest financial game changers of this decade? The unprecedented cycle of global central bank easing and low interest rates? The dramatic decline in oil prices? Fort Washington Advisors’ Nick Sargen discusses the economic and market moving shifts in energy, inflation and central bank policy – and what they mean for investors

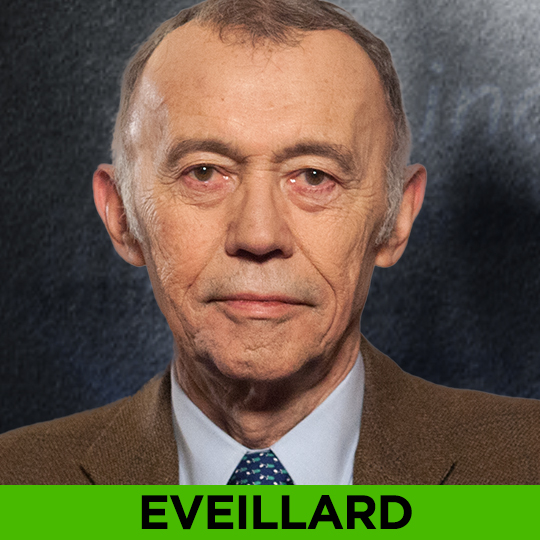

Eveillard: Legendary Value Investor

This page is here for technical reasons. Please click here for the episode page.

EVEILLARD: RETIREMENT PERSPECTIVE

Although still Senior Advisor at the First Eagle funds, legendary value investor, Jean-Marie Eveillard gave up active portfolio management at the firm back in 2009. Has his perspective about investing changed at all in retirement? Watch the related WEALTHTRACK episode.

INVEST WITH SOME TRUE VALUE INVESTORS

10 VALUE FUNDS 1999- 2003 Average Annual Return Group Average +10.8% S&P 500 – .57% COMMON VALUES Owned limited number of carefully researched companies Long-term orientation with low portfolio turnover Substantial investments in their funds Watch the related WEALTHTRACK episode.

EVEILLARD: LEGENDARY VALUE INVESTOR

An exclusive interview with legendary value investor Jean-Marie Eveillard, who was named Morningstar’s International Manager of the Year in 2001 and received its first Fund Manager Lifetime Achievement Award in 2003. A self-described value investor for 50 years, he is known for his meticulous stock research, cautious, contrarian views and emphasis on avoiding lasting losses for his shareholders. He’s able to share his personal views on investing, the markets and strategy now that he has retired from active management and is Senior Advisor at First Eagle Funds.

Lund & Bernstein: Changing Charity

We take a look at how the world of charitable giving is changing. Two heads of leading philanthropies, Jed Bernstein of Lincoln Center and Jack Lund of the YMCA of Greater New York discuss how organizations are adapting to new societal needs and donor demands.

WEALTHTRACK #1132, Originally broadcast on January 30, 2015