An exclusive on crisis investing with great investor Hersh Cohen. He shares his perspective gained from 50 plus years of experience.

WATCH NOW…

Archives for July 2020

Safe Haven Investing in the Bond Market

This page is here for technical reasons. Please click here for the episode page.

OWN SOME SAFE HAVEN INVESTMENTS

OWN SOME SAFE HAVEN INVESTMENTS VOLATILITY ON THE UPSWING MORE FREQUENT MARKET DISLOCATIONS GROUP THINK DRIVEN BY ALGORITHMIC TRADING Watch the related WEALTHTRACK episode.

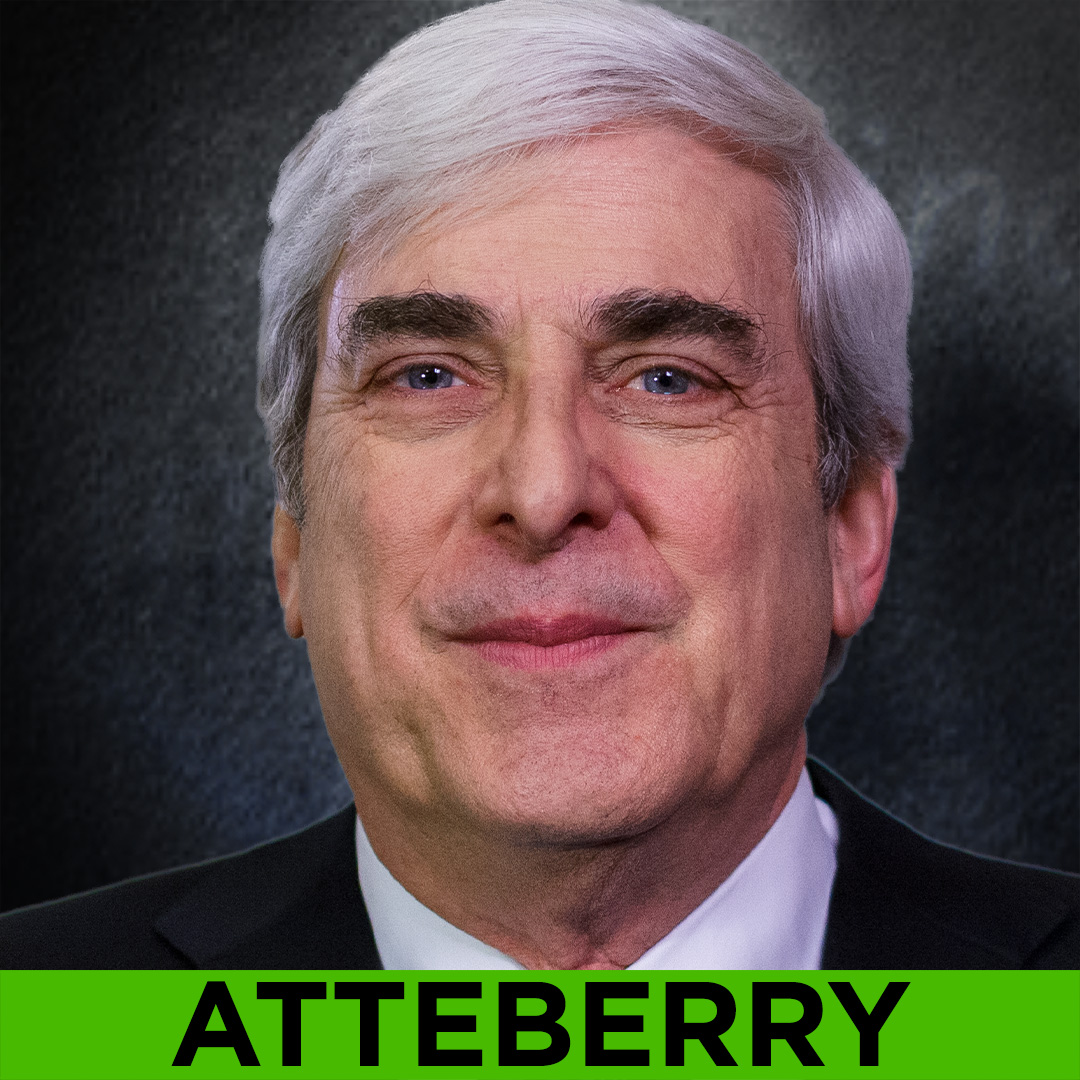

ATTEBERRY – PANDEMIC CHANGES

Award-winning short-term fund manager, Tom Atteberry reflects on some of the longer-term adjustments he is making in his personal and professional life as a result of COVID-19.

SAFE HAVEN INVESTING WITH FPA NEW INCOME FUND’S TOM ATTEBERRY

Tom Atteberry is a Portfolio Manager of the flagship FPA New Income fund. Atteberry brings us up to speed on conditions in the bond market, and how they have changed since Covid-19.

WATCH NOW…

MCLENNAN: PANDEMIC IMPACT

Matt McLennan has spent his career traveling to visit clients and businesses. COVID-19 stopped all of it. We asked him if he envisions making any permanent changes.