CONSIDER REBALANCING YOUR PORTFOLIO – Trim overvalued winners – Add to undervalued laggards Stock Portfolio Potential trims: U.S. stocks, especially small cap stocks Potential adds: Emerging market stocks Bond Portfolio Potential trims: High yield bond winners Potential adds: Short term Treasury notes and T-bills High quality emerging market government and corporate bonds

Archives for December 2013

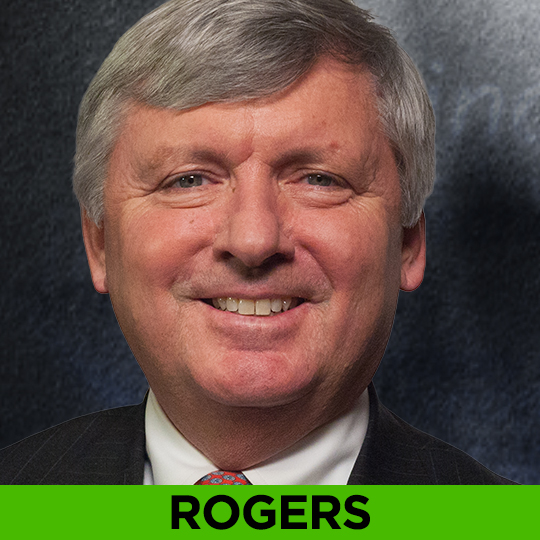

BRIAN ROGERS – NOTHING IS CHEAP

“What if nothing is cheap” in today’s market? In a rare interview, Brian Rogers, longtime portfolio of the T. Rowe Price Equity Income Fund, a Morningstar favorite, tells us why he’s worried about risks and “pockets of craziness” in the market and where he is finding value in an expensive world.

JAMES GRANT & RICHARD SYLLA: THE GREAT FED DEBATE!

Is the 100th anniversary of the creation of the Federal Reserve a cause for celebration or condemnation? Has the Fed, as Ben Bernanke said, “come full circle back to the original goal of preventing financial panics? Two financial historians, James Grant and Richard Sylla, debate the benefits and dangers of the Fed and explore its history with us.

GRANT & SYLLA: PAY ATTENTION TO WHAT FEDERAL RESERVE IS SAYING

PAY ATTENTION TO WHAT FEDERAL RESERVE IS SAYING – Fed is more forthcoming and transparent – Fed is world’s most powerful financial institution – Fed influences economy and moves markets

CORTAZZO & LEBENTHAL – MINIMIZING TAX PAIN

Nothing is certain but death and taxes and what is certain this year is that taxes have gone up. Increases in the social security tax rate, Federal laws such as the Affordable Care Act and the American Taxpayer Relief Act of 2012, and stock market gains mean many Americans are facing much higher tax bills. Financial advisors Alexandra Lebenthal and Mark Cortazzo will help us minimize the pain.

START TAKING SOME MONEY OFF THE MARKET TABLE

START TAKING SOME MONEY OFF THE MARKET TABLE Several WealthTrack Great Investors, like Don Yacktman and Steven Romick, are holding cash. – They see few undervalued investments – They own very high quality securities