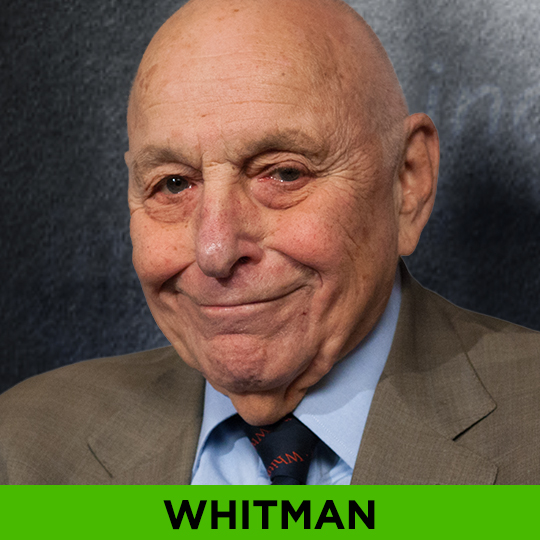

Third Avenue Management’s Founder and Chairman Marty Whitman has had enormous professional success as a deep value investor, but as a Jewish kid from the Bronx he once described feeling like a second class citizen for the first half of his life. How that has influenced him? We asked him.

Martin Whitman

MARTIN WHITMAN: THEY JUST DON’T GET IT!

They just don’t get it! That’s the view of legendary deep value investor Martin Whitman, Founder and Chairman of Third Avenue Management. In this exclusive interview taped at the Museum of American Finance, Whitman takes on Congressional and Wall Street ignorance about debt, credit worthiness, and earnings. Whitman will also discuss his long term mantra, to buy “safe and cheap” stocks, and his four elements to getting growth at dirt cheap prices.

Surviving the World’s Financial Crisis

Central banks around the world are responding aggressively with rate cuts and intervention. What can individuals do to protect themselves and position their portfolios for future profits? Two veteran value investors – legendary portfolio manager Marty Whitman, founder of the Third Avenue Funds and Hersh Cohen, chief investment officer of Clearbridge Advisors will guide us. Plus long-time friend and colleague of Fed Chairman Ben Bernanke, NYU Economics Professor Mark Gertler, will explain the immediate and long term impact of the global financial rescue efforts.