Central bankers are clearly worried about global growth. From the U.S., to Europe, to Asia, we have seen unprecedented levels of easing in recent weeks. By independent research firm ISI Group’s count, there have been more than 250 stimulative policy initiatives announced over the past 13 months. The firm also points out that we are less than 100 days from the famous fiscal cliff in the U.S., when numerous Bush era tax cuts expire and automatic spending cuts take effect if Congress and the White House can’t reach a budget compromise. If they don’t, estimates are that GDP growth could be reduced by as much as 3.5%, sending the economy into recession.

James Grant: The Federal Reserve’s Most Outspoken Critic

Federal Reserve Chairman Ben Bernanke has been widely credited with playing a key role in saving the global financial system from spiraling into a deeper recession. As a recent Financial Times headline read, “Central Bank Action Lifts Gloom”; “Bold Fed and ECB Moves Cheer Investors- Confidence Increases in U.S. and Europe.” There is no question […]

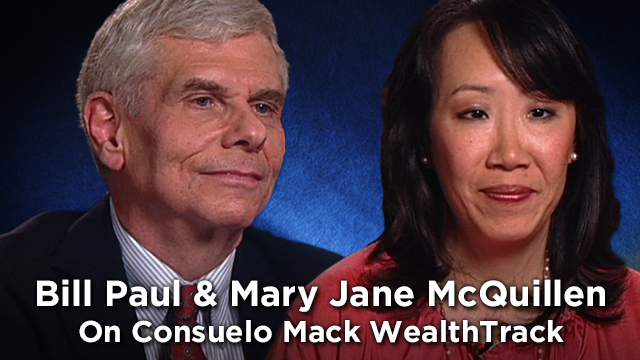

Mary Jane McQuillen & Bill Paul

We are kicking off a new season of WEALTHTRACK with the first of a two part series devoted to what’s being called “impact investing,” the practice of aligning financial goals with personal values. Impact investing goes beyond what used to be called socially responsible investing, which was designed to avoid certain businesses such as gambling, alcohol and tobacco. It is now pro-active as well, investing in companies that are making a positive impact in a wide range of areas including environmental, societal and governance (ESG).