Socially Responsible Investing is no longer a niche strategy. It’s gone mainstream as more companies, investment firms and investors pay attention to environmental, social and governance issues. And the belief that this approach means lagging performance has been proven wrong. SRI funds are now competing head on with traditional money management. This week’s guest is Barbara Krumsiek, the CEO of Calvert Investments Inc., a leader in SRI mutual funds and a Financial Thought leader in her own right.

Impact Investing

Amy O’Brien & Ingrid Dyott: Investing in a Socially Responsible Way

Impact investing, while not yet mainstream in this country is growing rapidly and is very much a global phenomenon. The financial times recently reported that “about 95% of the 250 largest global companies now report on their corporate responsibility activities, a jump of more than 14% from 2008. The Financial Times notes that two-thirds of those that do not report are based in the U.S. and the picture is more mixed among smaller companies. However increasing numbers of investors in the U.S. are paying attention to environmental, social and governance issues, or ESG as they are known in the trade. According to a report by the Social Investment Forum Foundation on socially responsible investing trends in the U.S.,“sustainable and socially responsible investing (SRI) in the United States has continued to grow at a faster pace than the broader universe of conventional investment assets under professional management.”

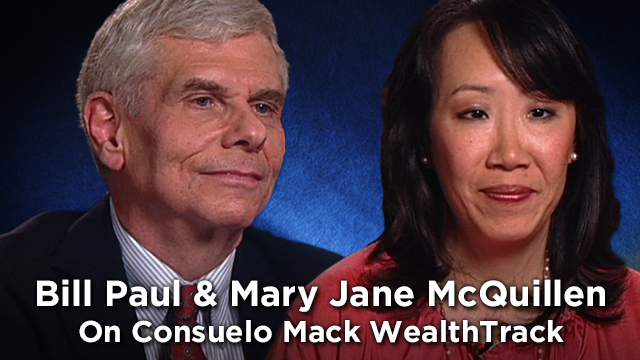

Mary Jane McQuillen & Bill Paul

We are kicking off a new season of WEALTHTRACK with the first of a two part series devoted to what’s being called “impact investing,” the practice of aligning financial goals with personal values. Impact investing goes beyond what used to be called socially responsible investing, which was designed to avoid certain businesses such as gambling, alcohol and tobacco. It is now pro-active as well, investing in companies that are making a positive impact in a wide range of areas including environmental, societal and governance (ESG).