Influential and outspoken economist and strategist Dave Rosenberg explains why he is as convinced now as he was going into the tech bubble and global financial crisis that the bullish consensus is wrong.

WATCH NOW…

RECENT PROGRAMS

NEW OPPORTUNITIES AND CHALLENGES FOR BOND INVESTORS WITH TOP-RATED BOND MANAGER, MARY ELLEN STANEK

One of Barron’s 100 most influential women in U.S. Finance, Mary Ellen Stanek, Chief Investment Officer of Baird Advisors and President of Baird Funds, discusses the rapidly changing conditions in the bond markets.

WATCH NOW…

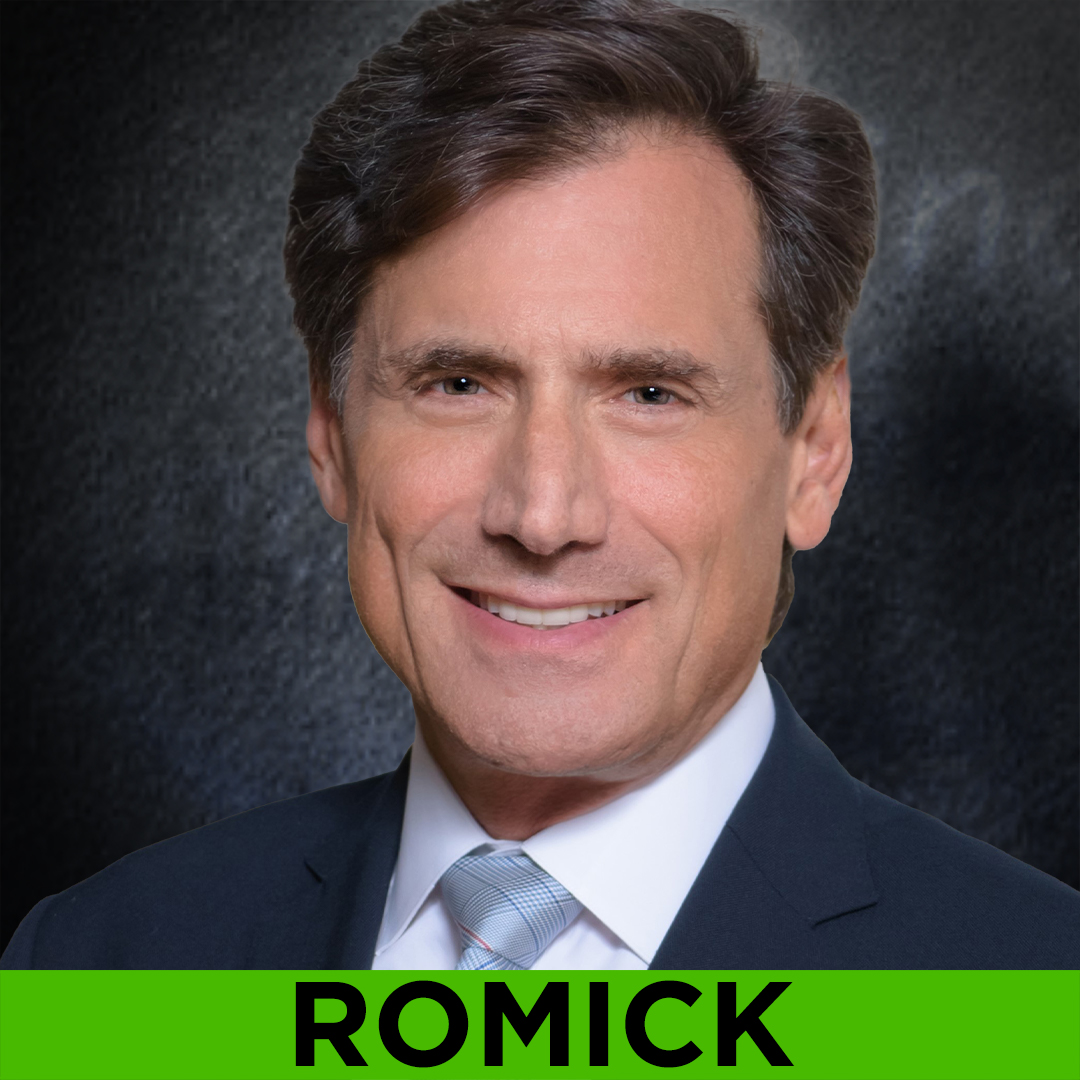

GREAT INVESTOR STEVEN ROMICK LOADED UP ON UNLOVED STOCKS DURING 2020 SELL-OFF. WHAT’S HIS PLAN NOW?

FPA Crescent’s founder and portfolio manager, Steven Romick has an impressive track record of delivering equity-like returns with less than stock market risk with his contrarian investment approach. You’ll never guess what he is buying now.

WATCH NOW…

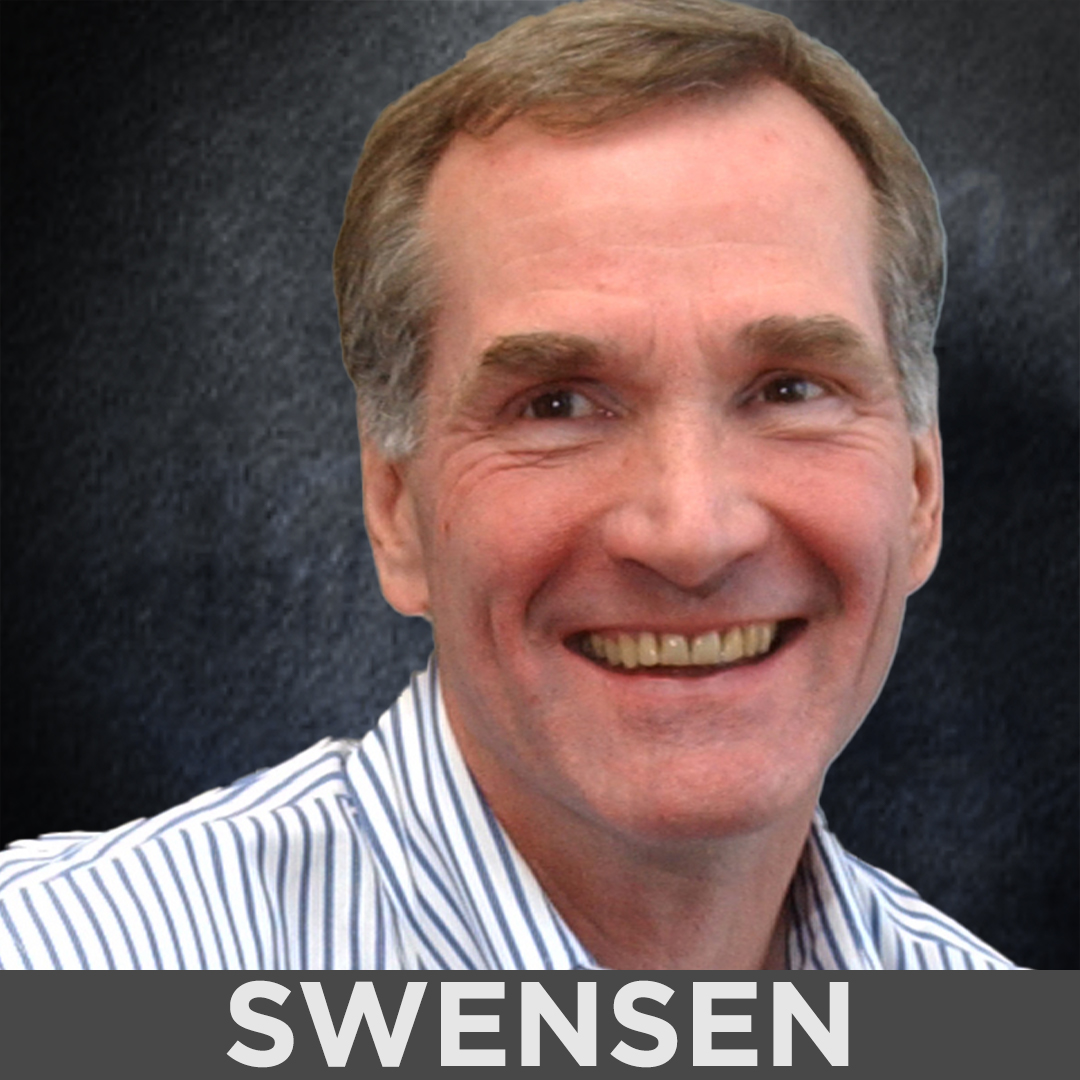

David Swensen

The legendary, long-time manager of the Yale Endowment revolutionized the way endowments and other institutions invest, de-emphasizing stocks and bonds and redirecting funds to long-horizon alternative investments such as hedge funds, private equity, and tangible assets. He cared deeply about helping individuals invest successfully as well. We were honored to have him as a WEALTHTRACK exclusive for two episodes several years ago.

HOW DO YOU TOP A +100% YEAR? BARON OPPORTUNITY FUND’S MICHAEL LIPPERT OUTLINES HIS HIGH GROWTH STRATEGY

5-star, gold-rated fund manager Michael Lippert says there is an embarrassment of riches in the high growth stock universe and he is focusing on the ones that will benefit the most from every aspect of the digital transformation.

WATCH NOW…

FOCUSING ON HIGHEST QUALITY GROWTH COMPANIES WITH MARGINS OF SAFETY PAYS OFF AT POLEN CAPITAL

Polen Capital’s outstanding 30+ year track record shows that the firm’s high conviction, low turnover focus on a small number of highest quality growth companies pays off. Damon Ficklin, lead Portfolio Manager of the Polen Global Growth fund talks about some of the companies that exemplify the strategy.

WATCH NOW…