An exclusive interview with the award winning portfolio manager of the MainStay Unconstrained Bond Fund. Dan Roberts says this is anything but a Reagan bull market and it is much higher risk.

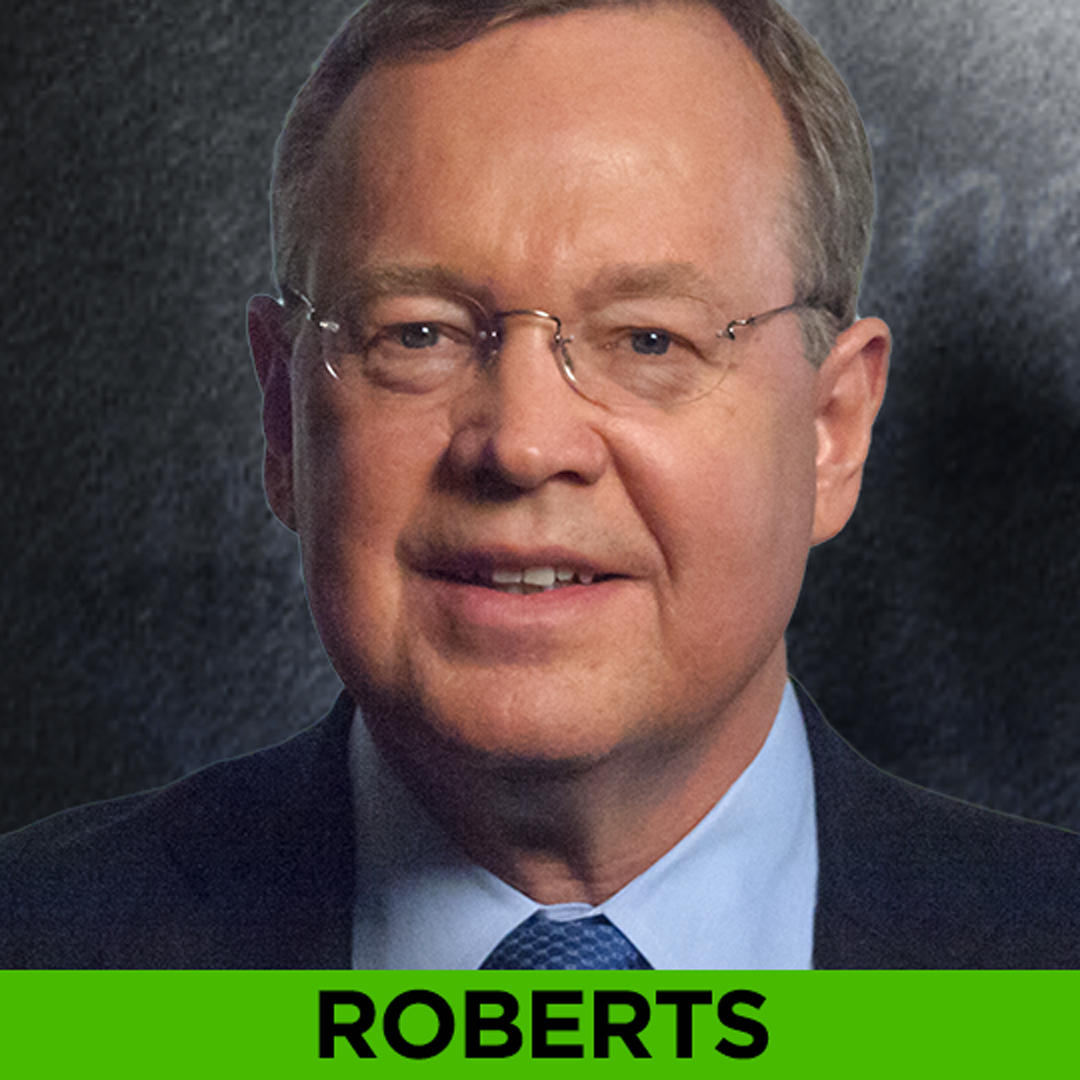

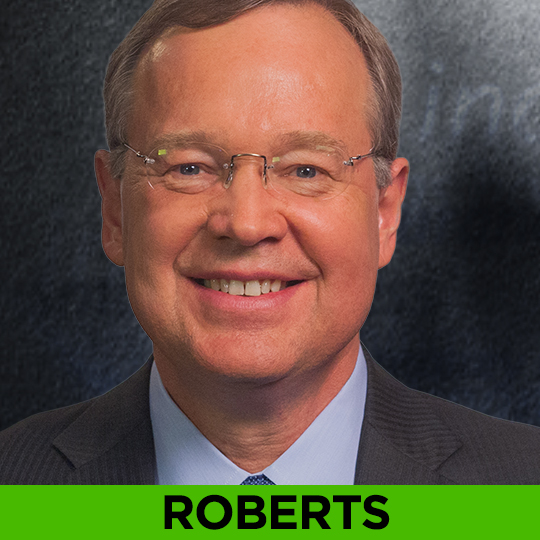

Dan Roberts

ROBERTS: UNCONSTRAINED FLEXIBILITY

Seeking higher returns and protection against an eventual rise in interest rates, investors have been turning to non-traditional “unconstrained” bond funds. According to Morningstar, nontraditional bond fund assets have more than doubled to a record $151.5 billion last year, from $62.5 billion in 2011.

On this week’s WEALTHTRACK, an exclusive interview with an award winning portfolio manager who is an expert in this field. Dan Roberts of the five star rated MainStay Unconstrained Bond Fund explains why investment flexibility is so critical in today’s complex markets.