PAY ATTENTION TO PRICE IN YOUR INVESTMENTS Watch the related WEALTHTRACK episode.

INVESTMENT REALITY

John Dorfman started out his professional career as a journalist, with successful stints at publications including The Wall Street Journal and Forbes, before making the switch to money management, joining legendary value investor David Dreman and then founding his own firm, Dorfman Value Investments. He describes the biggest difference between financial reporting and actual investing. […]

DORFMAN: VALUABLE INVESTING?

Are you better off with a robot? Dorfman Value Investment’s John Dorfman discusses why his robot list performs so well, but is not for most investors.

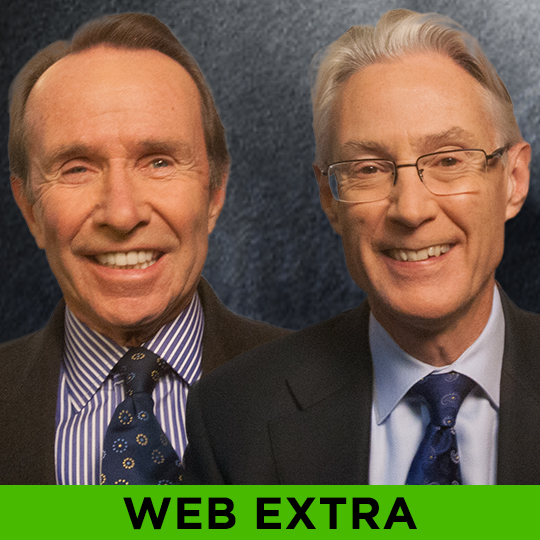

Hyman & Stattman: Part 2 – Exclusive 2016 Global Outlook

This page is here for technical reasons. Please click here for the episode page.

CONSIDER AN ACTIVELY MANAGED FUND THAT WILL GIVE YOU BROAD PORTFOLIO DIVERSIFICATION

CONSIDER AN ACTIVELY MANAGED FUND THAT WILL GIVE YOU BROAD PORTFOLIO DIVERSIFICATION BlackRock Global Allocation Fund vs. FTSE World Index (Since 2/89 Inception) Equity-like returns: Upside Capture: 70% Less than market risk: Downside Capture: 43% Watch the related WEALTHTRACK episode.

STATTMAN: GLOBAL IMPERATIVE

STATTMAN: GLOBAL IMPERATIVE Dennis Stattman has been managing the BlackRock Global Allocation Fund since its inception in 1989 when there were far fewer funds investing in multiple asset classes around the world. We asked him about the importance of being global. Watch the related WEALTHTRACK episode.