Start by reading company sustainability reports Check out socially responsible indexes: FTSE KLD 400 Social Index [info] MSCI USA ESG Select Index [info] Dow Jones Sustainability United States Index Dow Jones Sustainability North America Index [info] Watch this Episode

Archives for June 2012

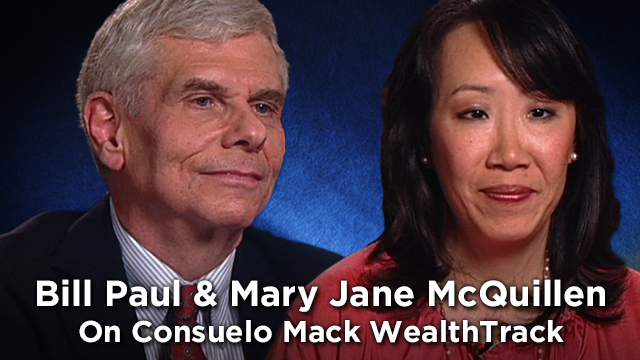

Mary Jane McQuillen & Bill Paul

We are kicking off a new season of WEALTHTRACK with the first of a two part series devoted to what’s being called “impact investing,” the practice of aligning financial goals with personal values. Impact investing goes beyond what used to be called socially responsible investing, which was designed to avoid certain businesses such as gambling, alcohol and tobacco. It is now pro-active as well, investing in companies that are making a positive impact in a wide range of areas including environmental, societal and governance (ESG).