This week on WEALTHTRACK, what history has to teach us about this year’s presidential election results and what they mean for the economy and markets. Noted financial historian Richard Sylla and leading investment strategist Jason Trennert are next on Consuelo Mack WEALTHTRACK.

Archives for November 2016

SYLLA & TRENNERT: ELECTION INVESTMENT LESSONS AND STRATEGIES

On this week’s Thanksgiving episode, we are revisiting our recent program about the impact of the election. Lessons from the past and strategies for the future with noted financial historian Richard Sylla and leading investment strategist Jason Trennert.

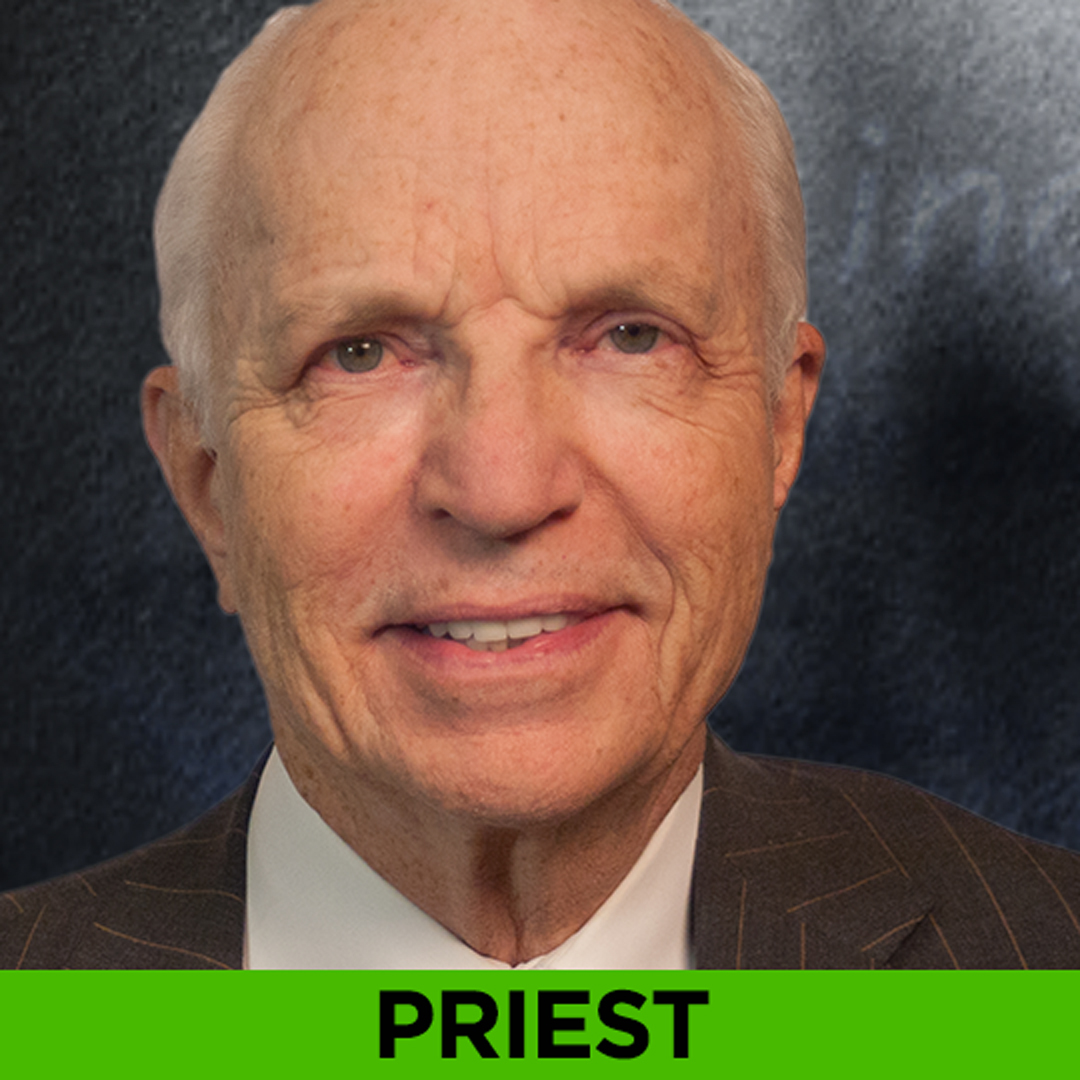

Priest: Investment Revolution

This page is here for technical reasons. Please click here for the episode page.

PRIEST: INVESTMENT REVOLUTION TRANSCRIPT

This week on WEALTHTRACK: How technology is revolutionizing the economy, business and investing. Epoch Investment Partners’ Bill Priest explains why tech is the new macro, next on Consuelo Mack WEALTHTRACK.

PRIEST: INVESTMENT REVOLUTION

How technology is revolutionizing business and investing with award winning portfolio manager, Bill Priest of Epoch Investment Partners.

WATCH NOW…

READ: THE SECOND MACHINE AGE

READ THE SECOND MACHINE AGE: WORK, PROGRESS AND PROSPERITY IN A TIME OF BRILLIANT TECHNOLOGIES Watch the related WEALTHTRACK episode.