This page is here for technical reasons. Please click here for the episode page.

episode_1549

MAKE SOME INVESTMENTS OUTSIDE OF THE COUNTRY

MAKE SOME INVESTMENTS OUTSIDE OF THE COUNTRY All Investors Tend to Have a Home Country Bias U.S. Has Been the Place to Invest for the Last Decade Its Late in the Economic and Market Cycle for U.S. Early in Cycle for Some Countries, Particularly in the Emerging Markets Some Countries Experiencing Economic Turnarounds and Political […]

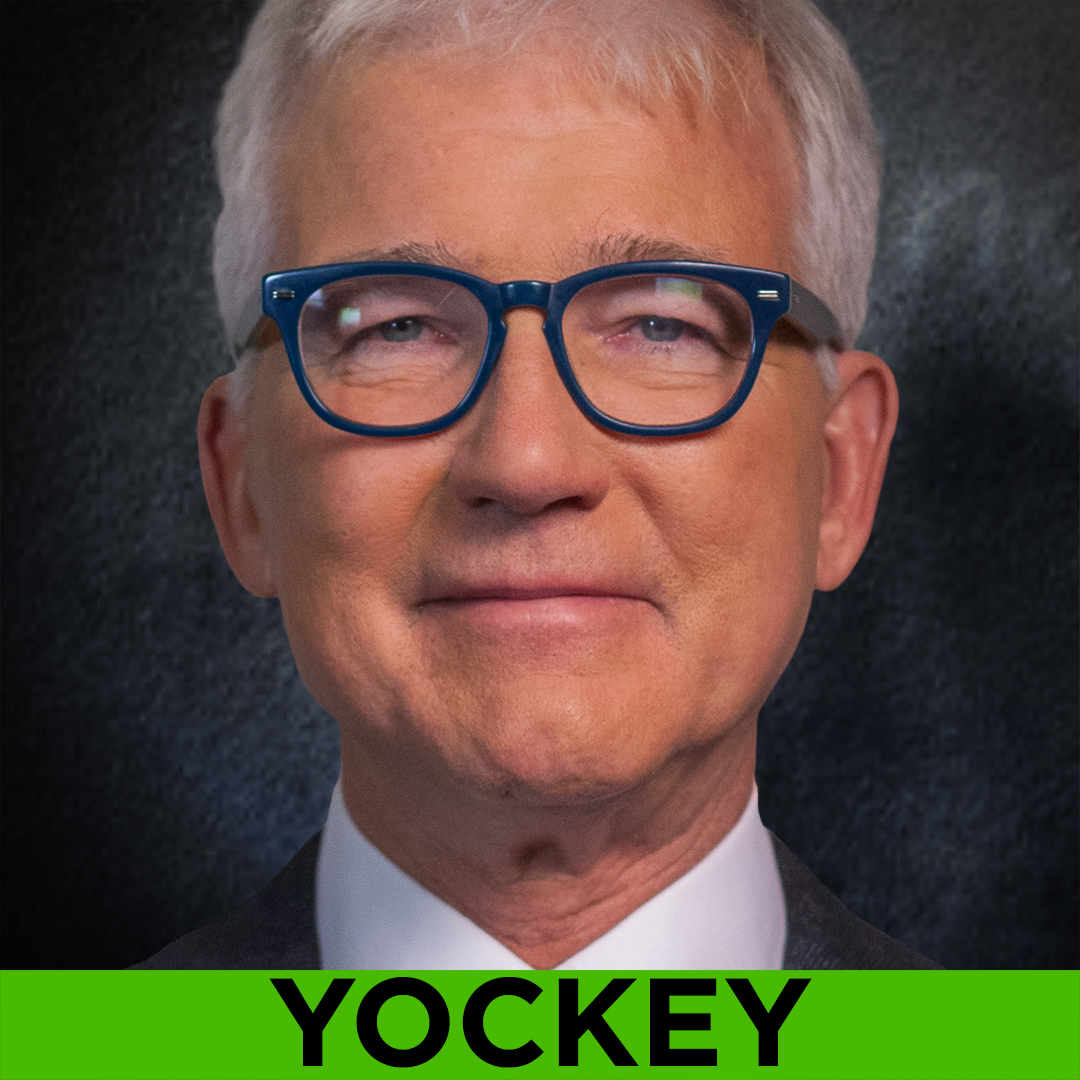

YOCKEY: HISTORICAL FICTION

HISTORICAL FICTION A history buff, Mark Yockey is a huge fan of Winston Churchill and a student of the entire World War II period. Among his favorite books are spy novels set in that era. Watch the related WEALTHTRACK episode.

SUSTAINABLE GROWTH AT REASONABLE PRICES: WHAT IN THE WORLD IS GREAT INVESTOR MARK YOCKEY FINDING?

It’s been a challenging time for global investors, especially those running international funds. This week’s guest is up to the challenge and has been investing overseas for nearly three decades.

WATCH NOW…