There’s a saying on Wall Street that the market can remain irrational longer than you can remain solvent. And there’s a widely held financial theory called “Reversion to the Mean” that asserts that eventually asset classes will return to their long term average in terms of several factors including price, price/earnings multiples, and their performance relative to other asset classes like U.S. stocks.

Reversion to the mean for emerging markets stocks has been a long time coming.

This week’s guest, Michael Kass who runs Baron Emerging Markets Fund believes their time has come after a very long cycle of underperformance.

Kass will make the case for an emerging markets resurgence, especially stocks in the two largest markets, China and India.

WEALTHTRACK Episode #1818 broadcast on October 29, 2021

Listen to the audio-only version here:

Explore This Episode

We have compiled additional information and content related to this episode.

MICHAEL KASS

- Portfolio Manager,

- Baron Emerging Markets Fund

- Baron International Growth Fund

- Baron New Asia Fund

- Baron Funds

ACTION POINT

KNOW YOUR SLEEP NUMBER AS AN INVESTOR

DAVID GARDNER’S SLEEP NUMBER QUESTION:

“What Number Would You Allow a Single Stock to Get at the Maximum as a Percentage of Your Overall Portfolio and Still Be Able to Sleep at Night?”

CONSUELO’S SLEEP NUMBER QUESTION FOR EMERGING MARKETS:

“What Is the Minimum You Would Allow Emerging Markets to Represent in Your Portfolio?”

ONE INVESTMENT

DECARBONIZATION PLAY

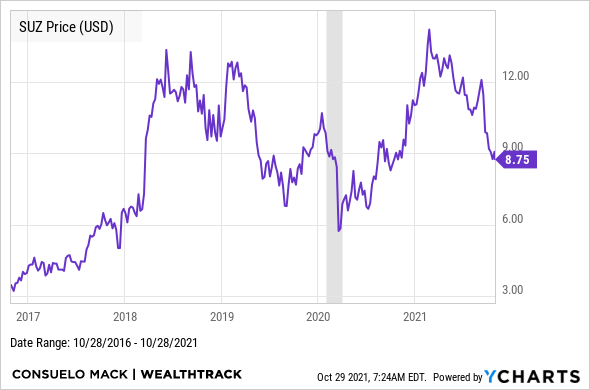

Buy Suzano S.A. (SUZ

STOCK MENTIONS

- Tencent Holdings Ltd ADR (TCEHY)

- Alibaba Group Holding Ltd ADR (BABA)

- ACM Research Inc. Class A (ACMR)

- Reliance Industries Ltd (RELIANCE) traded on NSE = National Stock Exchange of India

ARCHIVE

Michael Kass from the WEALTHTRACK Archives:

WEB EXTRA

NEW INVESTMENT DIRECTIONS

Baron Emerging Markets Fund Manager, Michael Kass recently launched Baron New Asia Fund to invest in the next generation of growth companies in Asia.