Large-cap U.S growth stocks, particularly tech stocks have been the overwhelming winners of the last decade. They now dominate the market. The top ten S&P 500 stocks, including the FAANGs, account for more than 25% of the index’s total market value, a concentration that worries some market watchers because it is reminiscent of other market tops such as the dot-com bubble when internet stocks made up over 30% of the S&P and the credit bubble when banking stocks reached more than 20%.

With the exception of short-lived spurts value stocks, small-cap stocks and international stocks have badly lagged.

This week’s guest believes the days of this concentrated outperformance by large-cap growth stocks are numbered and suggests some underloved and under-owned alternatives. He is financial thought leader, innovator, and investor Robert Arnott, Chairman of the Board of Research Affiliates, which he founded in 2002 as a self-described “research-intensive asset management firm that focuses on innovative products.”

Among the innovations that he has pioneered is fundamental indexation: building indexes with stocks based on the size of their fundamentals, such as sales, profits, cash flow, book value, and dividends – not their stock price. Research Affiliates has created numerous fundamental indexes for a wide variety of markets and asset classes around the world.

Arnott will discuss why he believes this long era of U.S. large-cap growth dominance could be coming to an end and what could take its place.

WEALTHTRACK Episode #1811; Originally Broadcast on September 10, 2021

Listen to the audio-only version here:

FIND OUT MORE…

INTRO ASSET ALLOCATION INTERACTIVE:

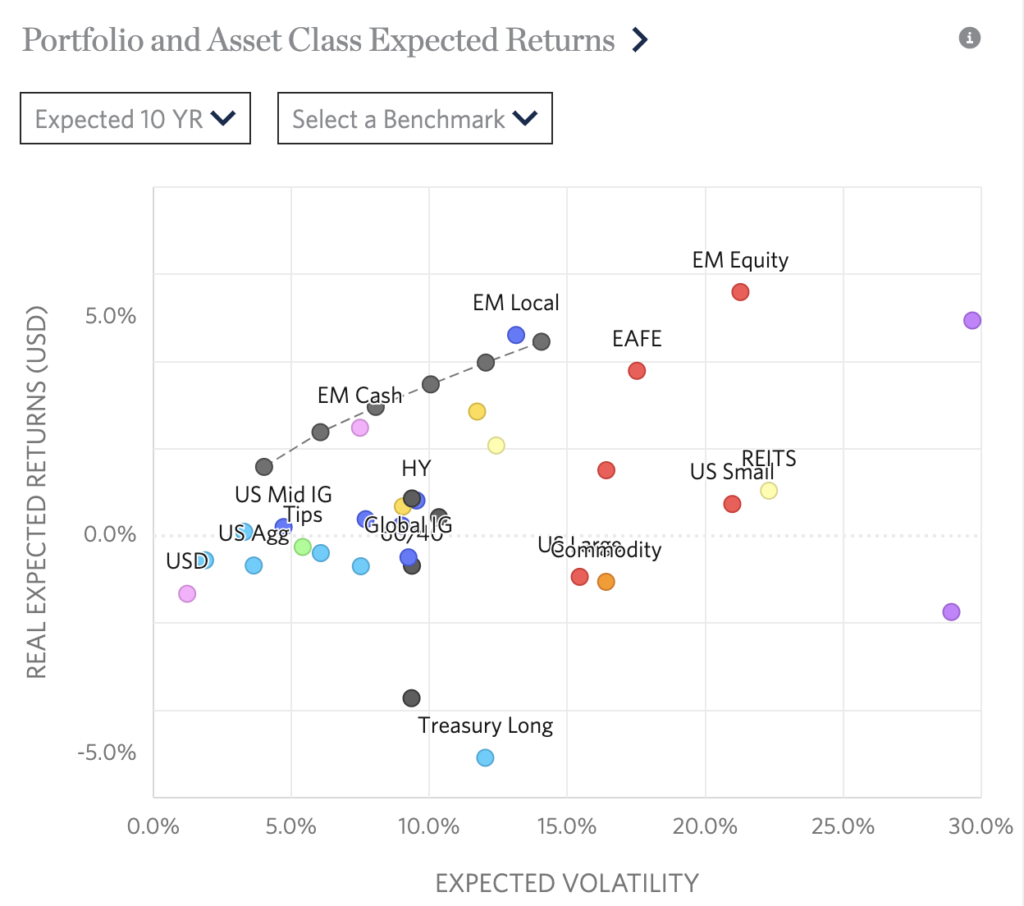

In 2002 financial innovator Rob Arnott launched one of the first all asset mutual funds, the PIMCO All Asset Fund. Since then his research-intensive firm, Research Affiliates has created a free website to project forward returns for numerous asset classes.

On a recent WEALTHTRACK Payden & Rygel’s Emerging Market bond specialist, Kristin Ceva brought us up to speed on opportunities in this vast but little understood market. Watch the episode.

Explore This Episode

We have compiled additional information and content related to this episode.

ROBERT ARNOTT

- Founder & Chairman,

- Research Affiliates

ACTION POINT

MAKE SURE YOU ARE TRULY DIVERSIFIED

- Not truly diversified until you own something that makes you uncomfortable

- Uncomfortable usually means: unpopular, underperforming and cheap

- “Uncomfortable” assets today include:

- Value stocks

- Emerging markets stocks and bonds

BOOKSHELF

ONE INVESTMENT

EMERGING MARKETS VALUE

Arnott’s Personal Holdings

PIMCO RAE PLUS EMG Instl (PEFIX)

PEFIX Total Return Level data by YCharts

PIMCO RAE Emerging Markets Instl (PEIFX)

PEIFX Total Return Level data by YCharts

Schwab Fundamental Emerg Mkts Lg Co ETF (FNDE)

FNDE Total Return Level data by YCharts

Freedom 100 Emerging Markets ETF (FRDM)

FRDM Total Return Level data by YCharts

ARCHIVE

Robert Arnott from the WEALTHTRACK Archives:

WEB EXTRA

CAUTION AHEAD

Research Affiliates Founder & Chairman Rob Arnott says there are bubbles galore in the market and a looming geopolitical risk with potentially catastrophic consequences.