Leading global value manager Matt McClennan discusses the risky mix of monetary and fiscal tightening amidst high debt levels in the US and identifies some companies that can succeed despite it.

Archives for January 2023

LEADING GLOBAL VALUE MANAGER MATT MCLENNAN ON COMPANIES THAT THRIVE DESPITE US INVESTMENT RISKS

Part 1 of 2

Leading global value manager Matt McClennan on companies that thrive despite US investment risks

CLARIDA: INSIDE THE FED PERSPECTIVE

Long-time Fed watcher Richard Clarida gained a different perspective, including some surprises once he was inside the Fed making policy decisions.

FORMER FED VICE CHAIR RICHARD CLARIDA SAYS THE FED WILL TIGHTEN UNTIL LONG-TERM INFLATION REACHES 2%

Former Fed Vice Chair Richard Clarida says the Fed is determined to get long-term inflation down to 2%, and some economic pain is inevitable.

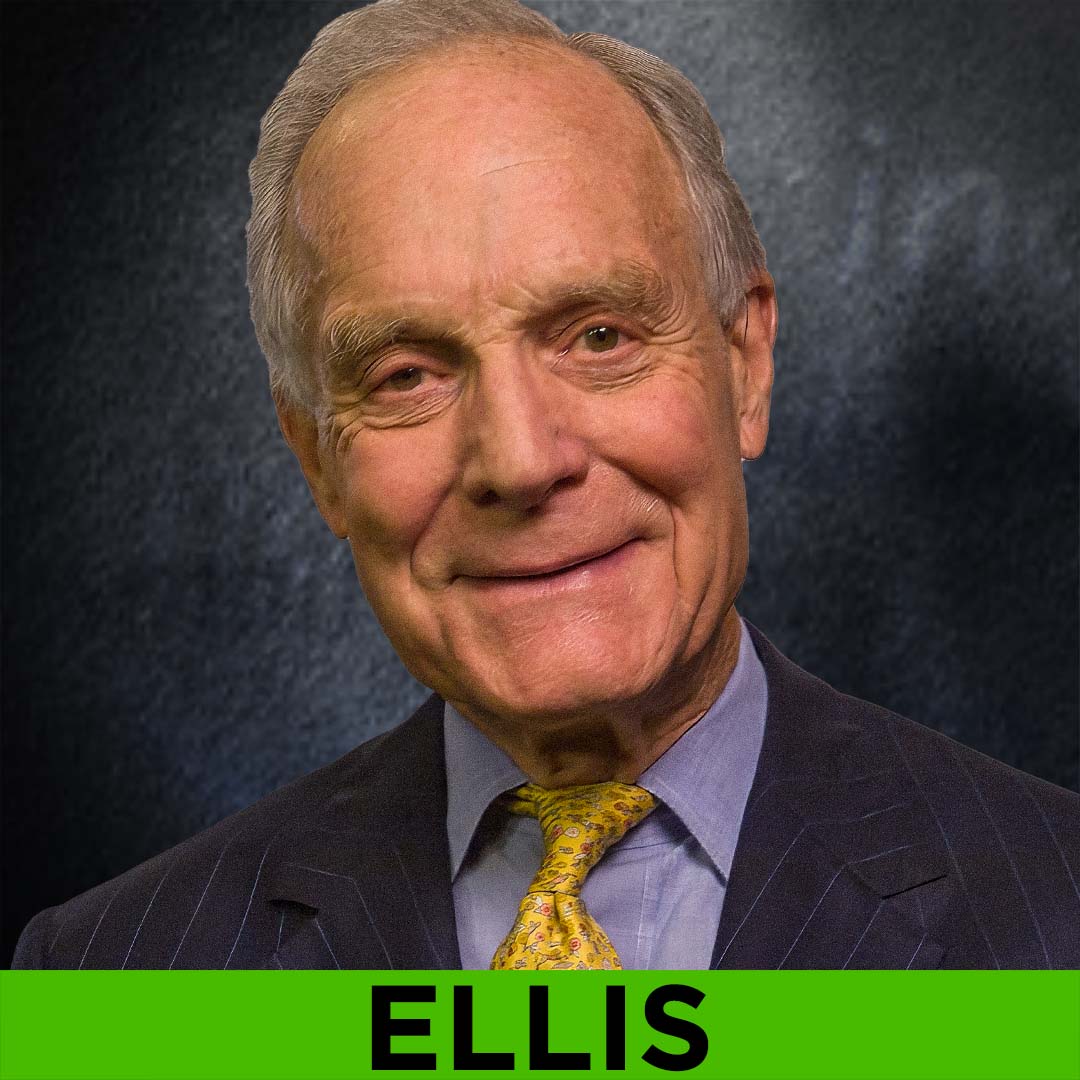

ELLIS: VANGUARD TRANSFORMED

Investment giant Vanguard has been closely identified with its founder John “Jack” Bogle, who created the first index fund for individual investors there in 1976. Bogle left the firm in 1996, but as Charles Ellis explains in Inside Vanguard, Vanguard underwent a transformation after Bogle left.

BUILDING A FINANCIAL PLAN TO MATCH YOUR UNIQUE NEEDS WITH INVESTMENT LEGEND CHARLES ELLIS

Part 2 of 2

Legendary financial thought leader Charles Ellis has spent 60 years researching and advising top investment professionals and firms. In part two of his exclusive WEALTHTRACK interview he discusses how individuals can create the best financial plan for their specific situation.