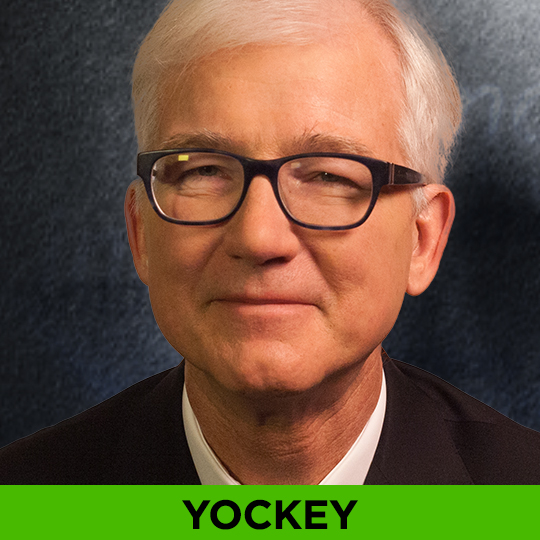

The bull market turned six years old earlier this month. How much of a concern is the market’s age and it’s more than 200% advance? In a rare interview, Artisan International and Global Funds’ Great Investor, Mark Yockey explains why he is still finding plenty of opportunities in the market and why the rising dollar is a financial game changer for many companies.

Archives for March 2015

YOCKEY: CHURCHILLIAN PRINCIPLES

Artisan Partners’ noted international investor, Mark Yockey is a huge admirer of Winston Churchill and has read volumes of the legendary British Prime Minister’s histories, autobiographies and biographies. We asked him what he admired most about Churchill, arguably the greatest leader of the twentieth century. Watch the related WEALTHTRACK episode.

SYLLA & STEIGER: CORPORATE MORALITY

Public television is holding its final winter fundraising drive this week so we are revisiting corporate morality. How would you rate the condition of moral values in this country today? Last year’s Gallup poll answers were not atypical. Only 2% of Americans surveyed rated our moral values as excellent – 42% said they were poor – and 74% felt that values were getting worse, not better. How does this translate to the business world?

Financial historian Richard Sylla and award-winning financial editor Paul Steiger discuss corporate morality and how companies have become fixated on short-term stock prices to the exclusion of broader, long-term goals.

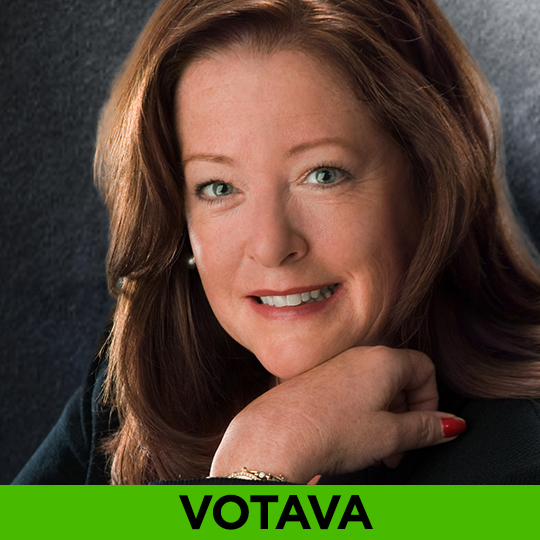

VOTAVA: MAXIMIZING MEDICARE

It is estimated that 95% of Americans receiving Medicare benefits pay too much for their coverage. How do you, or your loved ones avoid that fate? We asked Medicare consultant, Katy Votava to take us through the initial process of navigating the Medicare system and maximizing the benefits available.