Luck versus skill in investing! How much does each matter to investment success? Our guest this week, Financial Thought Leader Michael Mauboussin has written a new book on the topic. Titled The Success Equation: Untangling Skill and Luck In Business, Sports and Investing, its conclusions might surprise you.

Archives for December 2012

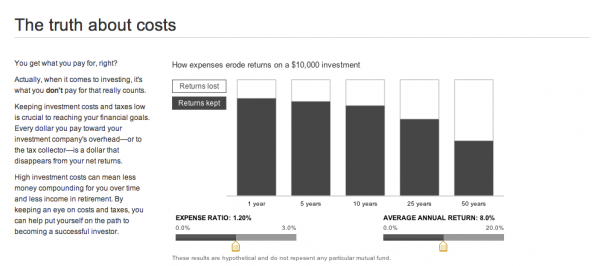

CHECK OUT THE IMPACT COSTS ARE HAVING ON YOUR PORTFOLIO

Use Vanguard’s “The Truth About Costs” tool on their website – you can see the returns lost and the returns kept over different periods of time depending upon the expense ratio paid and the average annual return you are expecting. Watch this Episode

Michael Mauboussin on landing his first job

A Financial Thought Leader who has written a fascinating new book titled, The Success Equation: Untangling Skill and Luck in Business, Sports and Investing. Author Michael Mauboussin is the Chief Investment Strategist at Legg Mason Capital Management as well as an award-winning Adjunct Professor at Columbia Business School. In his book, he analyzes how and […]