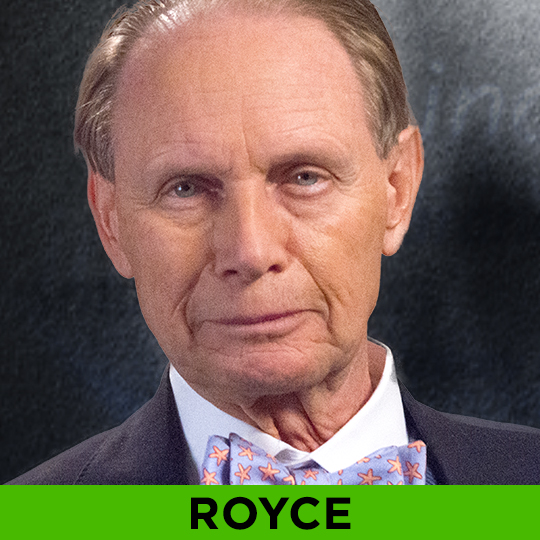

An exclusive interview with small-company stock pioneer Charles “Chuck” Royce. The Royce Fund’s Great Investor shares his forty years of lessons learned in the markets, what’s changed and what still works for long-term investment success.

REITs

SARGEN & KIM: THE BUILDING BLOCKS FOR FINANCIAL SECURITY

Two Chief Financial Officers of two top-rated insurance companies, New York Life’s John Kim and Western & Southern’s Nick Sargen share their portfolio strategies.

James Grant: The Federal Reserve’s Most Outspoken Critic

Federal Reserve Chairman Ben Bernanke has been widely credited with playing a key role in saving the global financial system from spiraling into a deeper recession. As a recent Financial Times headline read, “Central Bank Action Lifts Gloom”; “Bold Fed and ECB Moves Cheer Investors- Confidence Increases in U.S. and Europe.” There is no question […]

David Darst: Should You Trust the U.S. Financial Markets?

Financial Thought Leader, David Darst, Chief Investment Strategist at Morgan Stanley, where he criss-crosses the globe advising clients. He is also an acknowledged expert in asset allocation and a prolific author. Among his most recent books is a best seller, The Little Book That Saves Your Assets, which I highly recommend. I began the interview by asking David, given recent events, why should investors trust the financial markets.