Donald Yacktman, President and Founder of Yacktman Asset Management runs two five-star funds. Both have beaten the markets and their peers by wide margins over the years. This past Morningstar Stock Fund Manager of the Year explains while his approach to picking stocks has stayed the same, his current strategy is changing.

Oracle

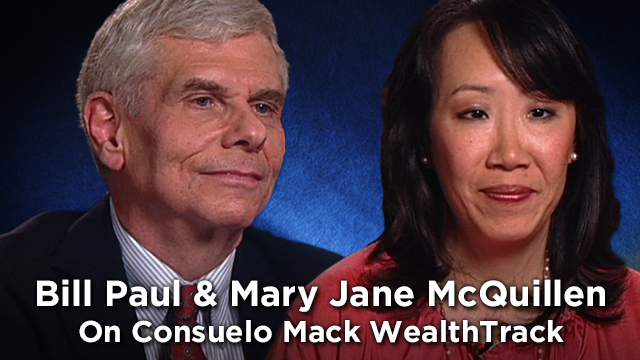

Mary Jane McQuillen & Bill Paul

We are kicking off a new season of WEALTHTRACK with the first of a two part series devoted to what’s being called “impact investing,” the practice of aligning financial goals with personal values. Impact investing goes beyond what used to be called socially responsible investing, which was designed to avoid certain businesses such as gambling, alcohol and tobacco. It is now pro-active as well, investing in companies that are making a positive impact in a wide range of areas including environmental, societal and governance (ESG).