Two economic thought leaders assess the still challenged stability of the global financial system.

WATCH NOW…

RECENT PROGRAMS

LATE CYCLE GROWTH OPPORTUNITIES? GAMCO GROWTH FUND’S MARKET BEATING HOWARD WARD LOOKS TO THE FAANGS

The FAANGS will continue to flourish, even in a late cycle market says market-beating portfolio manager Howard Ward who owns them in his GAMCO Growth Fund.

WATCH NOW…

THE “STORY OF THE DECADE”: WHY U.S. ECONOMY STRENGTHENS WHILE SETTING RECORDS FOR LONGEVITY

Top-ranked economist Nancy Lazar tells her “story of the decade”, why the U.S. economy is strengthening even as it sets records for expansion longevity.

ENVIRONMENTAL IMPACT INVESTING IS ATTRACTING DOLLARS & DELIVERING RESULTS. 2 EXPERTS SHARE STRATEGIES

Environmental impact investing is attracting dollars and delivering results. Two experts share their investment strategies.

WATCH NOW…

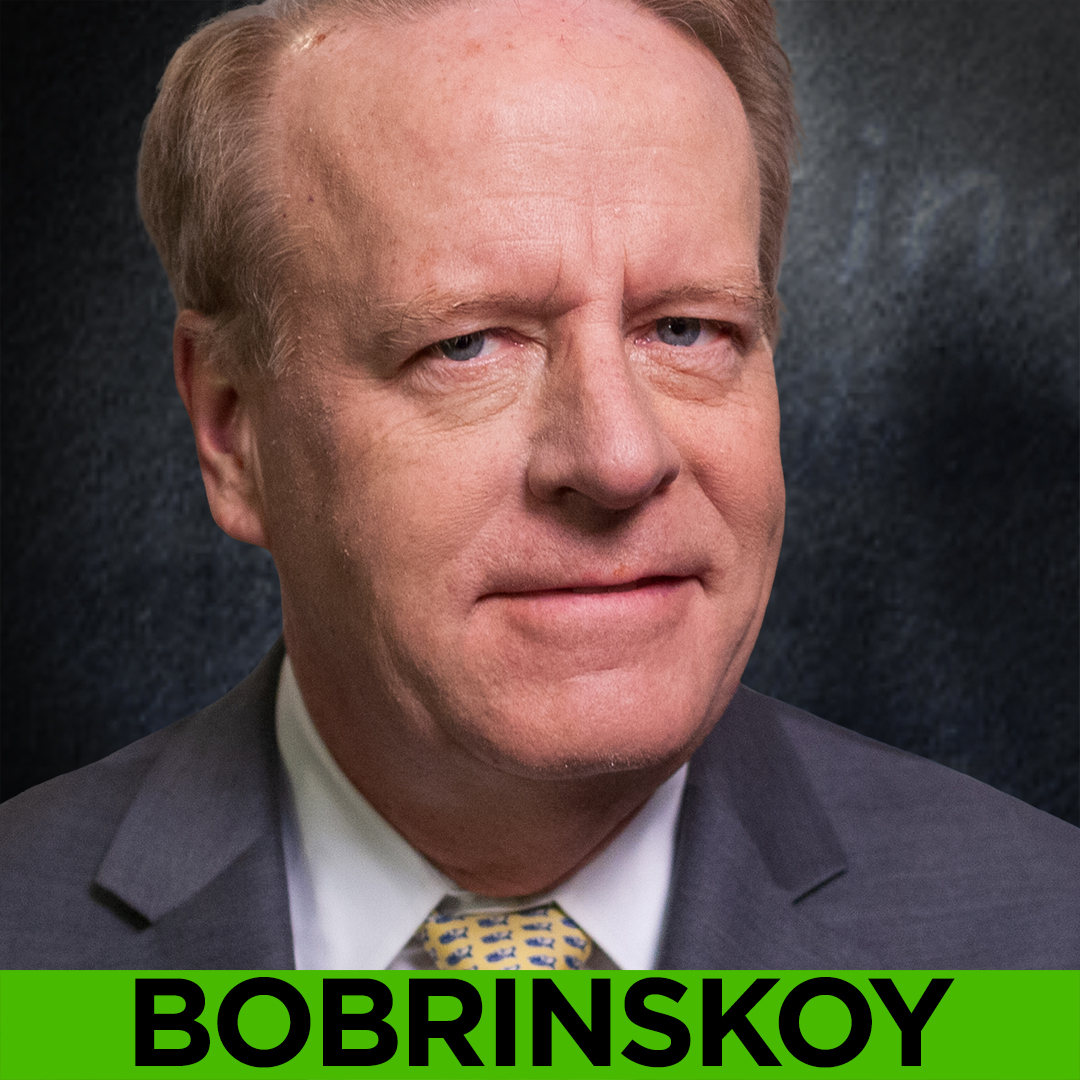

FINANCIAL CRISIS SURVIVAL LESSONS: BEATS MARKET & PEERS SINCE BOTTOM (ARIEL FUND)

Patience is usually considered to be a virtue except when it comes to investing. Investors are notoriously impatient when the funds they are in underperform the market for a few years. The magic number seems to be three. Key investment lessons from the financial crisis with Ariel Investments’ Charlie Bobrinskoy.

GREAT VALUE INVESTOR JOEL GREENBLATT REVEALS THE 2 SECRETS TO BEATING THE MARKET

In an exclusive interview, great value investor Joel Greenblatt reveals his two secrets to investment success.

WATCH NOW…